Fifth UCIMA's National statistic survey

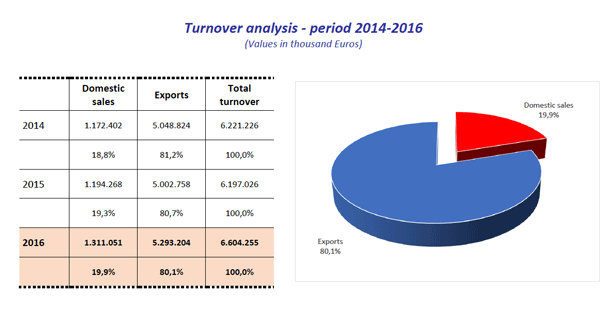

Italian packaging machinery turnover tops 6.6 billion euros. One of the driving sectors of Italian industry, it has posted further 6.6% growth. Exports make up 80.1% of sales, equivalent to 5.3 billion euros (up 5.8% on 2015). The domestic Italian market has seen an excellent performance with 10% growth in turnover to more than 1.3 billion euros. Food and Beverage are the main outlet sectors.

The Italian packaging machinery industry is bursting with health. According to data collected by the research department of UCIMA (the sector’s Confindustria-affiliated trade association), all the sector’s main indicators showed strong growth at the end of 2016.

Total turnover exceeded 6.6 billion euros, 6.6% up on 2015.

Exports generated 80% of turnover and climbed by 5.8% to 5.3 billion euros, while the Italian market surged to 1.3 billion euros (up 9.8% year on year).

The number of companies operating in the sector also increased, reaching 601 compared to the 588 of 2015, and employment rose by 1,738 (+6.2%) to a total of 29,644 people.

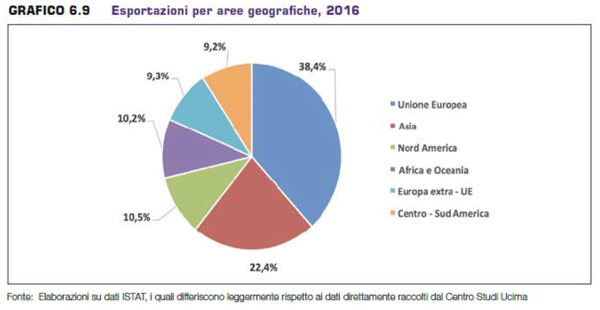

Results in international markets

The Italian industry maintains an extensive presence in international markets and is contending the leadership in innovation and market presence with German companies. One machine out of every five sold worldwide is made in Italy.

The European Union remains the most important market, accounting for 37.2% of total turnover (1,969.8 million euros). Asia is second with a value of 1,236 million euros and a 23.4% share of turnover.

The important North American market ranks third with 593.4 million euros (11.2%). Next come South America (507.6 million euros; 9.6%), non-EU Europe (495.6 million euros; 9.4%) and Africa and Oceania (490.9 million euros; 9.2%).

The United States, France and Germany remain the top three individual countries, followed by Poland, UK, Spain, China, Turkey, Mexico and Russia.

The domestic market

Italian domestic sales are continuing the positive performance of recent years, with a further boost provided by the government’s Industry 4.0 incentive scheme launched in the second half of last year. The 9.8% growth in 2016 was followed by a further 6.5% upturn in the first quarter of the current year.

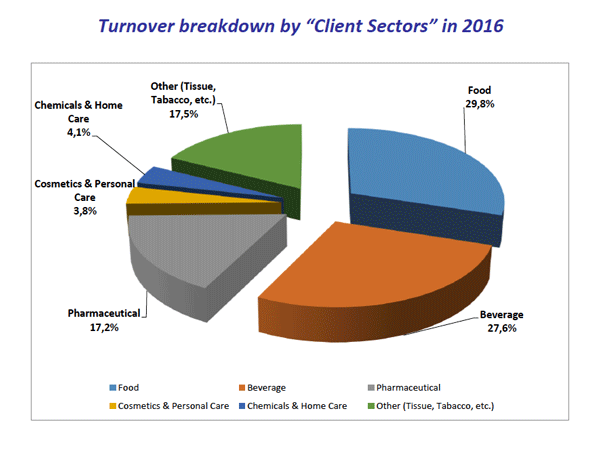

Client sectors

As for the breakdown of turnover amongst the various client sectors, food and beverage maintained its dominant position in 2016 accounting for 57.4% of total turnover.

Even taken individually, the two sub-sectors head the rankings. Food was the largest client sector in 2016, making up 29.8% of total turnover (1,970 million euros) and with an export share of 75%.

Beverage was second with 27.6% of total turnover, with exports making up 85% of the segment’s sales.

Next is the “Others” segment, which includes packaging machinery for tobacco, tissue, etc., with 1,156 million euros (17.5% of the total) and an export share of 83%, followed by the pharmaceutical machinery sector with 1,114 million euros (16.9% of the total) and an export share of 80%.

At the bottom of the rankings are the cosmetics and chemicals segments with turnovers of respectively 271 million and 268 million euros and amongst the lowest export percentages, 74% and 77%.

Cosmetics is the segment with the largest share of Italian sales (26%), while beverage is the most strongly export oriented (85%).

The structure of the sector

The Italian packaging machinery sector reflects the structure of Italian industry in general.

66.4% of companies have revenues of below 6 million euros and account for just 9.7% of the sector’s total turnover.

The 51 largest companies (with turnovers above 25 million euros) account for 68% of the sector’s total turnover.

Most companies are located in the Emilia Romagna region (36.9%), accounting for 62.1% of total turnover. Next come Lombardy (28.5% of companies and 17.6% of turnover), Veneto (11.6% of companies and 9.1% of turnover) and Piedmont (10.1% of companies and 5.7% of turnover).

Download the syntesis of the survey |

2017 forecasts

“We are very confident that in 2017 our sector will maintain the growth trend that has been under way for several years,” said UCIMA’s Chairman Enrico Aureli.

“The initial data available for the first quarter of the year reveal 13% growth in the sector’s turnover,” he added.

“We are very pleased with the contribution made by Italian domestic sales. Thanks to the Industry 4.0 incentive scheme we have seen 6.5% growth in the domestic market.

“Moreover, the forecasts of our Research Department point to average annual growth in packaging machinery sales of 4.8% over the three-year period 2017-2019.”