Italians in Zen mode (also regarding food)

Italians have welcomed 2023 with an unexpected interior serenity, looking to the future with confidence, despite fears and concerns. They are acting with particular rationality, putting individual well-being first, starting from the food they eat. This is the photograph taken by the two surveys of the Coop Research Centre conducted in December 2022: “The year to come” in collaboration with Nomisma and “Planning 2023 and Beyond”.

By Milena Bernardi

Having survived Covid, by now accustomed to war bulletins, grappling daily with the cost-of-living crisis, it seems that the Italians have learned the art of navigating in seas of uncertainty and, according to the latest Coop 2022 Report on today’s and tomorrow’s consumer habits and lifestyles, do so with a mood of fear (33%) and concern (22%), but most of all of confidence (39%) and expectation (38%) for 2023. Having got through a particularly difficult 2022, Italians are mostly showing an imperturbable acceptance of reality (28%) and a surprising interior serenity (34%). In this “Zen mode”, 26% of the sample in the first survey continues to associate with 2023 the word “hope”, with confidence levels up 12 percentage points compared to August 2022: a figure which surprises in a positive sense, in the light of the significant price increases which have hit the country, leaving deep scars in families, now more than ever oriented to savings and affection.

The most common strategy is that of adopting a slow lifestyle that allows you to focus on the closest things, such as self-care (among the highest-growing areas in 2023, with a 29% that intend to make more prevention and control check-ups), a return to domestic cooking (29%), and a flight from fast food (15% will reduce or stop). Renouncement of the superfluous to guarantee the essential appears, therefore, to be the predominant mood for the year to come.

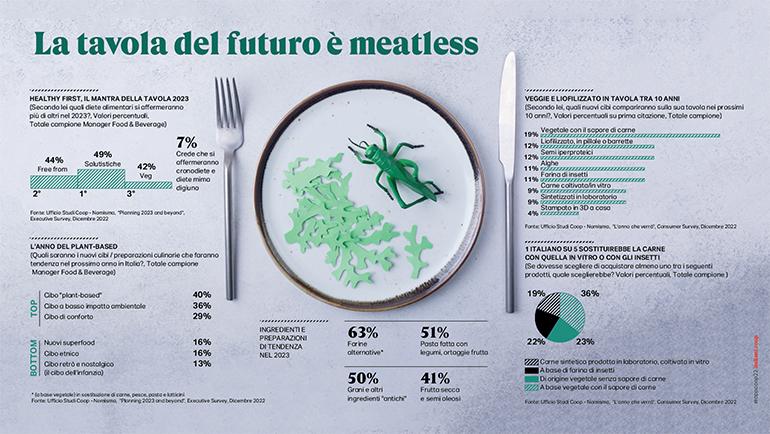

More sober and essential diets

Healthier and meatless diets, but also more sober and certainly “zero waste” and “no frills”. According to 40% of the Food & Beverage managers interviewed, 2023 will be a year in “Zen mode”, also with regards to food. New items on the shop shelves will be pasta and flour produced with ancient grains or products with low carb and higher protein content. The shopping trolley will, therefore, contain essential products, those most important for individual wellbeing. In this sense, premium and gourmet products are renounced, purchases of “ready to eat” and ethnic dishes are reduced, and there is a preference for distributor-brand foods and smaller producers compared of the big brands. In this way, also within a shrunk budget, families choose products of Italian origin, those from a controlled supply chain, products of tradition and the local territory, and high protein and plant-based products.

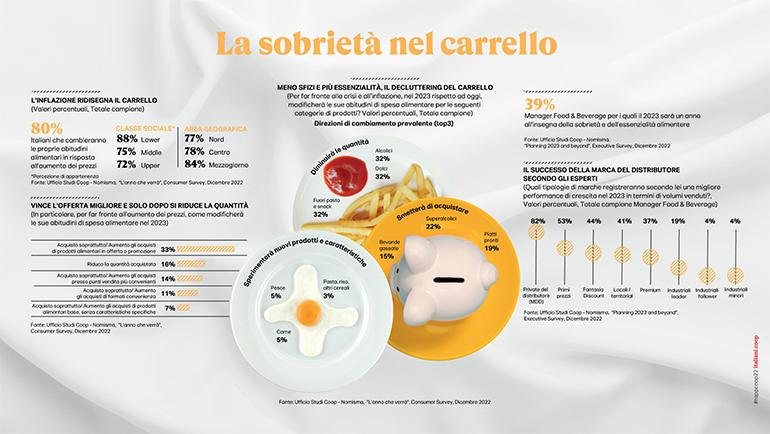

Decluttering the shopping trolley

Among the strategies adopted by consumers to preserve their shopping trolley, in first place there is greater attention to waste – an approach that 35% of consumers declare to want to implement – which is expressed in the compilation of a rational and organised shopping list, a correct preservation of food, the reuse of leftovers and the monitoring of food eat-by dates. In any case, we will try to preserve the quantity and quality of the products in the trolley: around one consumer out of three intends to pay more attention to offers and promotions, with particular reference to first-price offers while, with regards to the distribution channels, discount stores will be preferred compared to other less economic channels. Savings are also predicted on “away from home” expenses: 25% of the consumers interviewed will go without their coffee at the bar, or lunch or dinner with friends. Despite the cost-of-living crisis, purchasing intentions veer, however, towards products with little or no environmental impact and with sustainable packaging, also with a higher price (almost 4 Italians out of 5).

Change of gear necessary for mass retaining

In spite of a surprising resilience in consumption, mass retailing sales, while sustained by the increase in prices, suffered in the last months of 2022 a rapid deterioration in the volumes sold, which risks reoccurring again in 2023.

The recipe for resolving the situation is innovation and restructuring both in the organisation of business processes (affirmed by 38% of Italian managers in the F&B sector) and in the product and service (32%), as well as in the distribution channels and sales networks (26%). A phase of renewed competitive tension – both horizontal and vertical - seems to be opening up, which will imply heavy selection in the market, benefiting those competitors better positioned in the territory and which have been better able to interpret the market context in their relations with suppliers: in innovation in product format, the ability to contain costs and new value proposals for the final consumer.

Italian food retail will probably have a new guise at the end of this process.

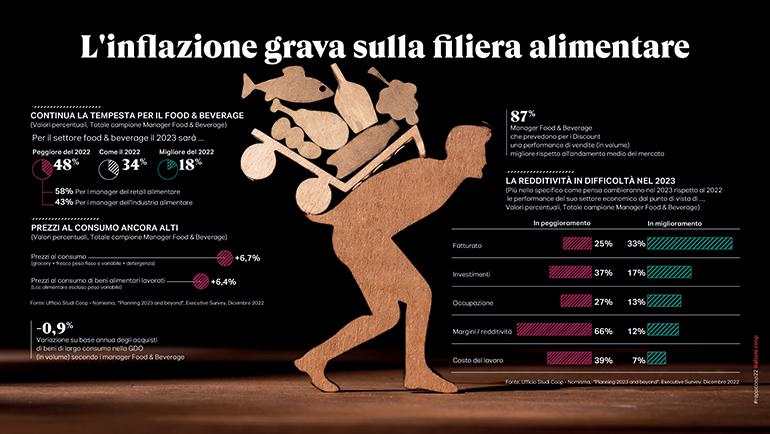

Mass retailing: 2023 outlook

For almost 1 manager out of 2, 2023 will be a worse year for the F&B sector compared to 2022. The Coop Research Centre, with the support of Nielsen’s analysis, forecasts for the year to come a positive trend in grocery sales by value in the offline channels and a negative trend for sales by volume, respectively +2.9% and -2.1%.

The forecast for the trend in sales by value is further confirmed in the consolidation of a number of dynamics, first and foremost the choice of Discount stores and grocery Specialists which, in 2023, could increase Grocery sales by value by respectively +5% and +5.2%. It is expected, moreover, that once more the large and small outlets (Hypermarkets and Self-Service) will achieve lower growths (+1.9% and +0.8%). In terms of effectiveness, among the most important strategic measures that, according to managers in distribution, enterprises in the sector should adopt, more than 2 out of 5 indicate investment in distributor-brand products which not only continue to be appreciated by consumers but, according to almost all the retail managers interviewed (87%), will achieve – in terms of volumes sold – the best growth performances in 2023. As well as investment in distributor brand products, among the strategic measures to adopt in the new year, 40% of interviewees indicate the experimentation of new formats and/or sales channels and 36% an improvement in shelf price positioning/price lists.

The luxury market is never in crisis

What we are seeing is an ever-greater widening of the social gap with the middle class forced to reduce expenditure and a better-off class that does not seem to feel the problem at all. Not surprisingly, the luxury market is growing: +46% in the sales in Italy of houses worth over a million euros (2021 vs 2020), +16% in the registration of luxury vehicles in the world (first half-year 2022 vs 2021). Dream holidays are a must for wealthy Italians: the number of people that stayed in a luxury hotel in 2021 was 2.8 million (+0.4% compared to 2019). More generally, in 2022, the sales of luxury goods at European level are forecast to rise by 50% compared to 2021 and by 20% compared to before the pandemic. The best performances are expected for leather goods (+11%), cosmetics (+11%) and footwear (+5%).

NOTE. The forecasts for 2023 drive from two surveys conducted in December 2022 by the Coop Research Centre and its partners. The first, in collaboration with Coop-Nomisma, “The year to come” conducted with the Cawi method in December, involved a sample of 1000 individuals representative of the population aged 18-65. The second, “Planning 2023 and Beyond”, was aimed at the community of the italiani.coop website, 700 opinion leaders and market makers, users of the past editions of the Report. Among these, 440 persons were selected with managerial/executive profiles (entrepreneurs, CEOs and directors, professionals) able to anticipate better than others the future trends of the country.