Packaging for cosmetics & perfumes

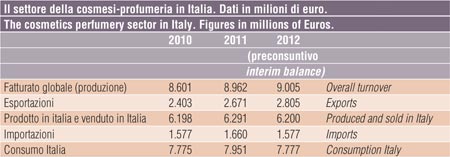

DATA AND FACTS Following a 2011 growth rate totaling 4.6%, in 2012 even the cosmetics/perfume sector had to “take account” of the worsening economic crisis in Italy and in Europe: the drop is in domestic demand, in particular, and the “historically” countercyclical nature of the sector has marked the time. On the other hand, subcontractors and exports are doing well. The numbers for packaging, by type and by quantity.

Based on an estimated balance developed by Unipro (Italian cosmetics enterprise association), 2012 should have ended with an approximately 2% drop in domestic demand; in particular, Italian producers’ sales are down -1.5%, and imports are down -5%.

Based on an estimated balance developed by Unipro (Italian cosmetics enterprise association), 2012 should have ended with an approximately 2% drop in domestic demand; in particular, Italian producers’ sales are down -1.5%, and imports are down -5%.

However, local manufacturers have managed to “minimize the damage” thanks to the good performance of exports, which grew by 5% (making the total drop equivalent to 1.5%).

Considering then Unipro’s projections, 2013 should mark a slight improvement, equaling around 1.2-1.5% and once again driven mainly by exports.

Since the domestic market is expected to further wane, the push for an ever increasing and increasingly determined internationalization is thus presented as the new frontier of the sector. In fact, the increased supply for the foreign market and the growth in turnover of Italian concerns (0.5% in 2012) intimate a margin for further growth internationally; in parallel to this, the necessity is arising for entrepreneurs to make targeted investments in research and development and equipment for production, maintenance and communication. In 2012, all distribution channels showed negative trends, excepting herbal products (which recorded +2.5% in sales) and subcontractors: this traditional aggregate of concerns that straddle the various sales channels saw +2.9% growth at the end of the semester, and expects another 3.9% for the first semester of 2013. It should though be stated that, while growth of herbalist’s shops is supported by the increase in domestic demand, the good results of those working on contract is to be mostly ascribed to the activity of exports carried out by small national producers that - not having structures suited to manage trade with abroad - externalize the same. In spite of the economic difficulties, Italian beauty concerns have continued to invest in research and development, and employment has remained stable.

Packaging: types and quantities

2012 is believed to have ended with the use of approximately 3,396 million packaging units made for cosmetics/perfume products and destined for both domestic and export markets. Compared to 2011, there has been growth limited to 0.5%: this slight growth can be attributed to exports.

Glass. Bottles, vials, jars, etc. present a total share of 23.9% of all primary packaging used for packaging the various products of the cosmetics sector. This share is showing positive growth.

Plastic. Tubs, bottles, tubes and rigid packaging continue to be the most widely used types, with a total share of 42.6%. The most important shares are distributed in the following sectors: hair products 75%, body care 58%, face and makeup 64%, lipstick 68%, deodorant 50%, hand products 35%. During the two-year period 2011/2012, this area has shrunken slightly.

Plastic. Tubs, bottles, tubes and rigid packaging continue to be the most widely used types, with a total share of 42.6%. The most important shares are distributed in the following sectors: hair products 75%, body care 58%, face and makeup 64%, lipstick 68%, deodorant 50%, hand products 35%. During the two-year period 2011/2012, this area has shrunken slightly.

Rigid and flexible polylaminates. This one proves to be the packaging type showing progressive growth. The PE/ALU/PE flexible tube holds a total share of 18.8%; flexible polylaminates for converting, mainly single dose pouches, hold 4%; their use in the hand product and perfumes sectors has a positive growth trend. In many cases, these two categories of packaging are competing with plastic containers.

Metal. As for metallic packaging, which is to say spray cans, boxes, rigid tubes, etc., they can be divided between aluminium and steel. In total they hold a 9.5% share, but they are losing ground compared to the previous year. The drop affected steel containers in particular, which went from 3% to 2.5%. Aluminium spray cans held their existing position for the most part..

Paperboard. The paperboard box remains the most commonly used presentation secondary packaging, absolutely necessary for the communication system of many high end products. It is estimated that the use of the case concerns approximately 45% of packaging, and a use of approximately 1,320 million units has been calculated, a slight increase over 2011.

Paper. The presence of packaging solutions with primary packaging consisting in a paper bag (talcum powder) or paper wrapping (bar soaps) is mostly stable at 1.5%.

Plinio Iascone

Istituto Italiano Imballaggio