Cosmetic sector: resilient, supportive and sustainable

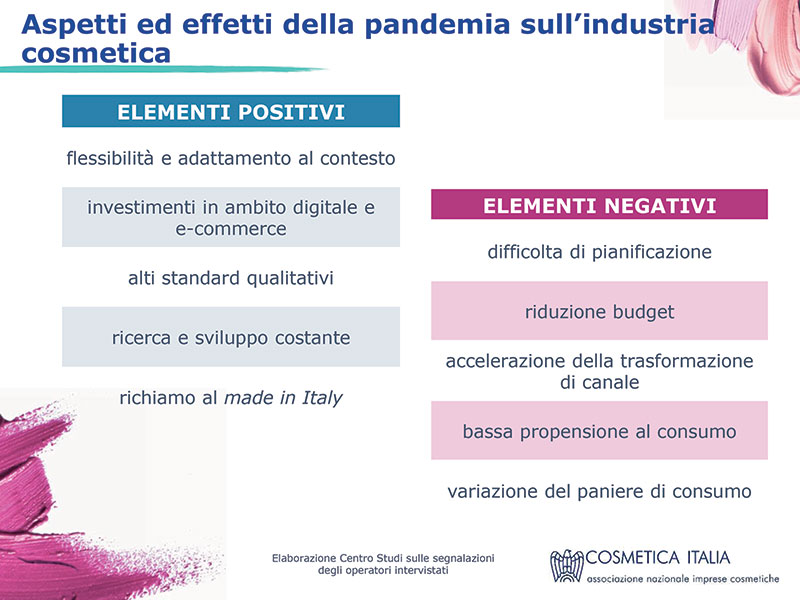

The Italian cosmetics industry is reacting with determination to the crisis situation imposed by the global pandemic. In spite of the undeniable drop in turnover, the sector remains in fact a flagship of the national industrial system. This is testified by the preliminary 2020 results obtained from the economic survey of Cosmetica Italia.

The figures emerging from the survey presented in February by the Cosmetica Italia Study Center essentially outline the impact that the pandemic has had on the sector: both global turnover as well as exports show contraction.

And yet, the cosmetics industry looks to 2021 as the year of recovery, with a view to further consolidation in 2022. Expected growth, therefore, thanks to the indispensable nature of cosmetics and the ability to adapt of a sector that does not give up on research, invents alternative distribution models with greater involvement in the digital sphere and proposes itself as the guardian of an increasingly natural beauty, an expression of wellbeing and health.

Figures and expectations. The survey well describes the reactivity of an industry that, straddling the two main epidemic peaks, has been able to react, delivering less critical final balances than expected, despite the negative signs.

According to the 2020 pre-consultation data, the industry’s global turnover is close to 10.5 billion euros (-12.8% compared to 2019); the values of the domestic market are also down (-9.6%).

Affected by limitations and uncertainties at the international level, exports register a -16.5% and reach a value of over 4 billion euros; instead, the value of the trade balance is close to 1.9 billion euros.

For both of these indicators, cosmetics ranks third among non-food goods, in comparison with adjacent sectors, after clothing-fashion and furniture.

«The prospects for recovery in 2021, although far from the values of 2019, are linked to the countercyclical nature of the sector. Cosmetics are in fact an indispensable asset, as the pandemic itself has reminded us» - comments Renato Ancorotti, president of Cosmetica Italia. «Last year we witnessed an acceleration in the change of behavior models, the redefinition of international balances and the evolution of the organization of work and personal relationships: phenomena that were likely to materialize in the medium term. On the one hand, companies feel the drive to restart, but on the other they need new and solid conditions to be able to achieve this, accompanied by a government plan capable of supporting them, also in terms of promotion of Made in Italy, in terms of innovation, digitalization and development on foreign markets».

Channel trends. The survey highlights the dynamics of reaction to the pandemic, conditioned by specialization as well as by the limitations affecting them.

The professional channels, hairdressing (-28.5%) and beauty (-30.5%), are affected by the forced closures of the first lockdown, as well as - for beauty - further restrictions by geographical area, with reference to the regions in the red zone.

Heavy contractions are registered in direct sales (door-to-door and mail order) that close the year at -30% compared to 2019. Conditioned by the new purchasing methods that have shifted consumption to other channels, perfumery drops 27%.

Signs of difficulty also come from herbal medicine, -26%, with different trends between single-brand and traditional stores.

Pharmacy and large-scale retail trade, on the other hand, are the channels that, although with shrinking data, have contained the drops: in fact, both close 2020 with a trend of around -2.5% (remember that large-scale retail trade continues to represent over 41% of cosmetics consumption).

In the wake of previous surveys, only e-commerce shows positive data, with a value that stands, according to preliminary data, at 700 million euros (+42% compared to 2019), bringing digital retail to fourth place among distribution channels with a weight of 7.4% on the total 2020 market.

Finally, turnover from subcontracting falls to 1,370 million euros (-17.5%), conditioned by the contraction of foreign demand, a traditional driver of growth for Italian subcontracting manufacturers.

The new classification of CCN&S

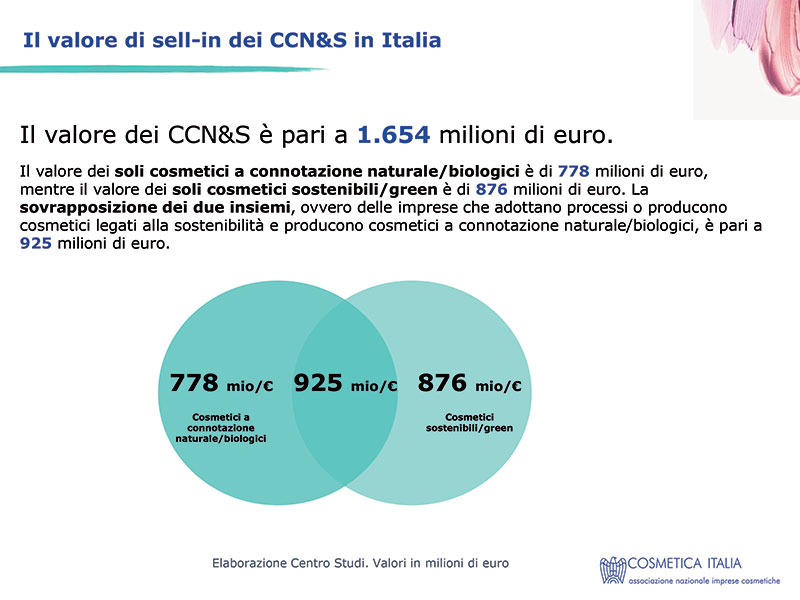

Mapping of the phenomenon of CCN&S (cosmetics with natural and sustainable connotation) among Cosmetica Italia member companies, based on the responses obtained from 106 companies, with a turnover (sell-in) of 7.1 billion euros.

At the regulatory level, there is still no unequivocal definition of the concepts of “natural/bio” and “environmental sustainability” with reference to cosmetics.

However, in view of the growing demand for products with natural connotations and oriented towards environmental sustainability, and with the aim of carrying out statistical surveys on the sector, Cosmetica Italia felt the need to draw up a classification perimeter, identifying two areas:

Cosmetics with natural/organic connotation - Product characterized by graphic or textual elements (claims) that communicate its natural/organic connotation, in line with its formulation composition, i.e. the presence of a high number of organic ingredients or ingredients of natural origin.

This cosmetic can also communicate: compliance with the international standard ISO 16128; natural/organic certification according to the protocol of a specialized private body; compliance with its own self-defined characterization, in accordance with Regulation 655/2013.

Cosmetics with a connotation of environmental/green sustainability - Product characterized by graphic or textual elements (claims) that communicate the connotation of environmental/green sustainability in areas that may relate to its entire lifecycle and/or corporate policies towards sustainability (environmental, social, economic).

By way of example, these areas may concern: production processes; packaging characteristics; sustainable management of the supply chain; product environmental footprint; product certification.

Companies can also communicate their practices related to the field of environmental sustainability through other tools (Environmental Management System certification, corporate certifications, sustainability report or balance sheet and international awards/recognitions).