Cosmetics-perfumery packaging

Overall picture of the Italian beauty market: production, exports, materials and packaging use.

Authoritative sources such as Sole 24 ore describe the global cosmetics market as resilient to economic difficulties that have globalized since 2009.

And, despite having ended 2013 with a drop of 3.8% at a 175 billion euros (which was followed in 2014 by a substantial settling down to contained levels of consumption), the longterm forecasts say that figures should double in the next 10 -15 years, drawn on by China, USA, Brazil, India and Japan.

The national scenario

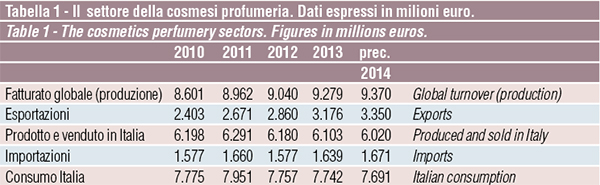

According to calculations by Cosmetica Italia, the national sector association, in 2014 companies registered a growth in production of + 1%, despite a still receding domestic market.

Once again it was foreign demand that supported the growth in sales, that put in a +5.5%: Indeed this positive trend enabled the limitation of the effects of the fall in domestic consumption, down 1% (seen to be progressively dropping since 2012). The good results in exports are due to the high competitiveness in of Italian manufacturers in terms of quality and innovation.

Imports to Italy are seen to be up by around 2%: in 2014 the flow of imports covered 22% of Italian domestic consumption, a figure that has remained largely stable in recent years.

74% of cosmetics/perfume products are for women and 26% for men.

Large retailers in turn confirm their position as the most important sales channel for cosmetics, with a value close to 3,800 million euros, and showing an upward trend.

Direct sales are on the increase, as a result of the changing needs of consumption regarding traditional channels: the growthtrend is seen to show an annual average of around 3%.

Perfumery, by contrast, is the channel most affected by the change in consumer buying preferences, featuring a downtrend of 2.7%. In turn herbal medicine remains one of the most dynamic traditional channels, with an average annual growthrate of 2.4%.

According to Cosmetica Italia, in 2015 Italian domestic consumption will continue to drop slightly (-0.3%), while exports will show a further growth of 7%, imports should increase by 3% and overall manufacturing by +2,3%.

The growth potential of the Italian cosmetics industry thus remains positive, both as regards internal demand, and more particularly so for exports; scenario stems from a general and growing attention by the consumer to the personal care and wellness, but also on the ability of companies in the sector to develop new products.

Packaging: types and quantities

2014 should have ended with a substantial confirmation of the use of packaging for cosmetics and perfumery products for both the domestic market and for exports. Against a use of 3,392 million packs in 2013, in fact, in 2014, the number should increase to about 3.35 billion. A progressive and more significant recovery is expected starting from 2015, when the Italian domestic market should also show growth.

Glass. Bottles, flasks, jars, and various rigid containers account for a global share of 23.8% of total primary packaging used for the packaging of the various cosmetics products. Its position is dominant in the important area of perfumery.

Plastics. Jars, bottles, tubes, rigid packaging continue to be the most used, with a share of 42.7% on overall figures. The most significant shares feature the following sectors: products for hair treatment, body and facial treatments as well as makeup, lipsticks, deodorants and handcare products.

Rigid and flexible polylaminates. This area shows progressive growth.

The PE/ALL/PE tube has a global share of 18.9%; flexible polylaminates for converters, in practical monodose sachets, are at 3.9%; though their use the hand and perfume and perfume product sectors are on the increase. In many cases, these two types of packaging materials are in competition with plastic containers.

Metal. As for the metal packaging, or that is canisters for spray products, tins, rigid tubes, etc., they fall into the categories of aluminum and steel. At a global level they have a market share of 9.4%, though figures are down on the previous year. The drop in share has notably affected steel containers, that have gone from 3% to 2.5%. Aluminum spray canisters have largely held their own.

Paper&board. Substantially stable at 1.3% the presence of packs with primary packaging comprising a paper sachet (talc) and paper wrappers (soap).

Significant too the presence of the cardboard case in the cosmetics-perfumery sector, which in fact confirms its position as the most used secondary packaging, absolutely necessary in the communications systems for many high-end products. Around 45% of the packs involve a case, a total of some 1,320 million units being calculated.

Plinio Iascone

Istituto Italiano Imballaggio