IMA, first half of 2019: Revenue and order book are growing

Bologna, August 7. The Board of Directors of IMA S.p.A approved the Group results at 30 June 2019, which is expected to be a year of growth. The Group acquires 60% of Perfect Pack S.r.l. thus completing the range of machines for single-dose packs in the pharmaceutical market. An extraordinary shareholders’ meetings on August 8 of IMA and GIMA TT approved the merger plan for the incorporation of GIMA TT into IMA

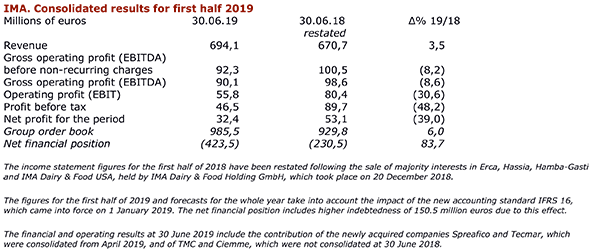

The IMA Group has closed the first half of 2019 with consolidated revenue of 694.1 million euros, showing growth of 3.5% compared with 670.7 million euros at 30 June 2018.

Gross operating profit (EBITDA) before non-recurring charges amounts to 92.3 million euros (100.5 million al 30 June 2018), gross operating profit (EBITDA) comes in at 90.1 million euros (98.6 million at 30 June 2018) and operating profit (EBIT) at 55.8 million euros (80.4 million at 30 June 2018).

Profit before tax amounts to 46.5 million euros (89.7 million at 30 June 2018) and net profit for the period totals 32.4 million euros (53.1 million at 30 June 2018).

The Group order book reached 985.5 million euros, +6% compared with 929.8 million euros at 30 June 2018, thanks to the closing of numerous negotiations in the various business areas of the Group.

In the first six months of 2019 orders acquired amounted to 726.9 million euros, a decrease of 7.5% compared with the same period last year, because of the contraction in the Tobacco business not entirely offset by the growth in the Pharmaceutical and Tea, Food&Other businesses.

The IMA Group has closed the first half of 2019 with growing results in the Pharmaceutical and Tea, Food&Other businesses, thanks to the positive trend in sales of automatic machines and complete lines to the reference sectors, but with a decrease in the Tobacco sector due to a lower order book at the beginning of the year.

Results in the first half of 2019 include the contribution of the newly acquired companies Spreafico and Tecmar, consolidated from April 2019, and TMC and Ciemme, not yet consolidated at 30 June 2018.

In the first half of 2019, these companies generated total revenue of 43.1 million euros and EBITDA before non-recurring charges of 4.3 million euros. At 30 June 2019, they had net financial debt of about 16.2 million euros and an order book of 45.5 million euros.

The IMA Group's net debt at 30 June 2019 amounts to 423.5 million euros (230.5 million at 30 June 2018), net of the outlay for acquisitions of about 41.4 million euros. This figure increases by 150.5 million euros due to the introduction of IFRS 16, the new accounting standard in force since 1 January 2019.

IMA Group forecasts for the whole of 2019

The first-half results and the size of the order book at 30 June 2019, together with the order trend in July, allow us to confirm our forecasts of a further year of growth for IMA despite the contraction of the Tobacco business that will be more than compensated by the Pharmaceutical and Tea, Food&Other businesses.

For 2019, if current conditions are confirmed in the coming months, the IMA Group estimates revenue exceeding 1.6 billion euros and a gross operating profit (EBITDA) of more than 290 million euros including the effects of IFRS 16, the new accounting standard in force since 1 January 2019, with a significant increase in net profit compared with 2018.

The President's comments. In commenting on the Group's performance at 30 June 2019, Alberto Vacchi, IMA's Chairman and CEO, declared: «The first-half results show an increase in revenue and a slight reduction in margins due to the contraction of the Tobacco business, not entirely offset by the improvement in the Pharmaceutical and Tea, Food&Other businesses.

Good order acquisition, together with numerous negotiations close to completion in all business areas, still allows us to look with confidence at the Group's performance in the coming months.

The recent acquisition of ATOP represents the most important operation in the history of IMA and the best opportunity to position ourselves as a leader in the field of industrial automation applied to E-traction, significantly expanding IMA's diversification.

In the last few days,

ATOP has signed an important agreement with one of the main Asian car makers for the supply of a line for the production of stators using "hairpin" technology, confirming its leadership position in this market. In addition to strengthening our positions in the main development areas of the world - the Chairman concluded - we will continue to invest in research and innovation, which is the basis of the Group's strong competitive positioning, with the consolidation of the IMA Digital programme and the launch of IMA NOP (No Plastic) for packaging that uses new environmentally friendly materials.

The size of the consolidated order book at 30 June, together with the positive trend in orders at the end of July, allow us to forecast further growth in 2019 compared with the previous year, with good prospects for 2020 as well».

Acquired 60% of Perfect Pack Srl. On August 7 IMA has acquired 60% of Perfect Pack S.r.l., based in Rimini and held by Mr. Roberto Talacci, an important player in the design, production and marketing of automatic sachet machines and complete lines for single-dose packs for different markets: pharmaceutical, cosmetic, nutraceutical and chemical.

IMA's financial intervention amounted to 12.5 million euros for the equity value. The company closed 2018 with a turnover of more than 9.7 million euros and an EBITDA of approximately 2.9 million euros, with 23 employees.

Mr. Talacci has been granted a put option to sell the other 40% of Perfect Pack S.r.l., which can be exercised in April 2024 and April 2029.

The merger plan for the incorporation of GIMA TT into IMA Gima has been approved

Bologna, 8 August 2019 - The Extraordinary Shareholders’ Meetings of each of I.M.A. Industria Macchine Automatiche S.p.A. (“IMA”) and GIMA TT S.p.A. (“GIMA TT” and, together with IMA, the “Companies Participating in the Merger”), which were convened in Ozzano dell’Emilia (Bologna), approved the merger plan for the incorporation of GIMA TT into its parent company IMA (the “Merger”) in line with the terms and conditions already communicated to the market by the Companies Participating in the Merger.

The exchange ratio has been set in No. 11.4 IMA ordinary shares with a nominal value of Euro 0.52 for each No. 100 GIMA TT ordinary shares. There is no cash balance.

For use in the exchange ratio, the Extraordinary Shareholders’ Meeting of IMA resolved to increase its share capital for a maximum nominal amount of Euro 2,081,417.52, by issuing up to No. 4,002,726 new ordinary shares.

For accounting and tax purposes, the transactions recorded by GIMA TT will be accounted for on the financial statements of IMA starting from 1 January of the year in which the Merger is effective and the Merger is expected to be completed at the latest by the end of the current year.

For further information on the Merger, please refer to the explanatory reports and documentation relating to the transaction made available to the public on the websites of the Companies Participating in the Merger www.ima.it and www.gimatt.it.