Health & Pharma travels fast on the web

From emergency purchases during a pandemic to (almost) normal purchases, looking first and foremost for convenience and comfort with home delivery. Digital health in Italy counts 18 million buyers and is worth 1.5 billion euros (+43.3% over 2020). Evidence from the Netcomm Focus Digital Health&Pharma.

Milena Bernardi

The future of healthcare will be increasingly connected, integrated and able to generate value. This was established by the third edition of the Netcomm Observatory on digital Health&Pharma (H&P), carried out with the support of Aboca, Farmacie Italiane, Human Highway and Nestlé, which investigated the evolution of the online market from September 2020 to September 2021, giving us a clear picture of the dynamics of the sector in Italy.

Despite the presence of much looser pandemic restrictions, in the period under examination e-commerce of H&P products reached the value of 1.5 billion euros, generating a growth of 43.3% compared to 2020, an increase sustained in particular by the increase in the frequency of purchase.

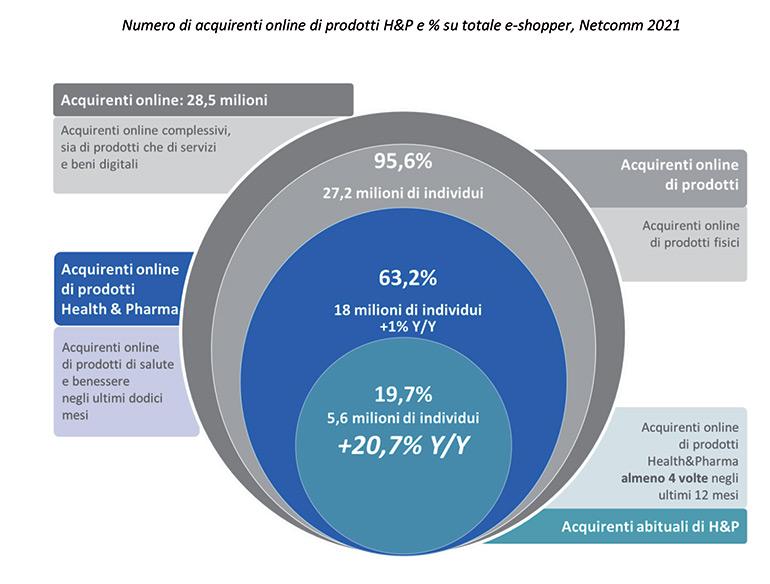

The research has shown that in the twelve months the threshold of 18 million Italians who have bought H&P products online has been reached (in 2020 they were 16.9 million), of which 5.6 million represented by regular buyers (+20.7% on 2020). 35% of respondents said they had an H&P site of reference, while in 8.7% of cases the customer buys on a site they had previously visited and liked, even if they had not purchased.

As for products, the three most popular categories - 46% of total spending - are vitamins and supplements, optical products and natural remedies. Drugs, dermo-cosmetics and muscle relaxants, on the other hand, are the categories where offline purchases prevail.

Main touchpoints and purchase drivers

The Netcomm survey shows that the Health&Pharma customer journey is very articulated and characterized by numerous digital and non-digital contact points, especially in the phases preceding the purchase: search engines are increasingly proving to be the ideal place to find information on a brand or a point of sale (+16.6%), but word of mouth also remains important (+11.9%). This is followed by advice from non-health professionals (+6.9%), such as nutritionists and personal trainers.

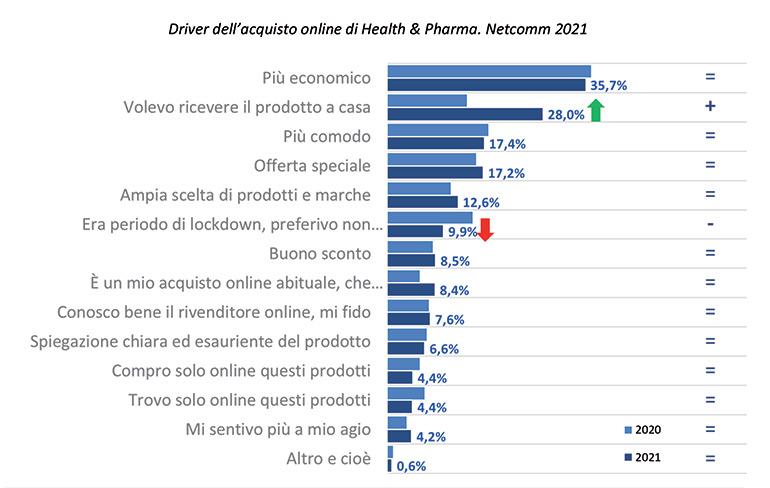

Convenience, savings, offers are the main purchase drivers. The service desired by consumers of H&P products must therefore necessarily be reliable, fast, but above all convenient. In the last year, in fact, the number of people who chose e-commerce because they were “forced” to do so by restrictions has decreased, while the number of those who use the channel for the convenience of receiving the product at home has increased (+28%).

The most used sales channels

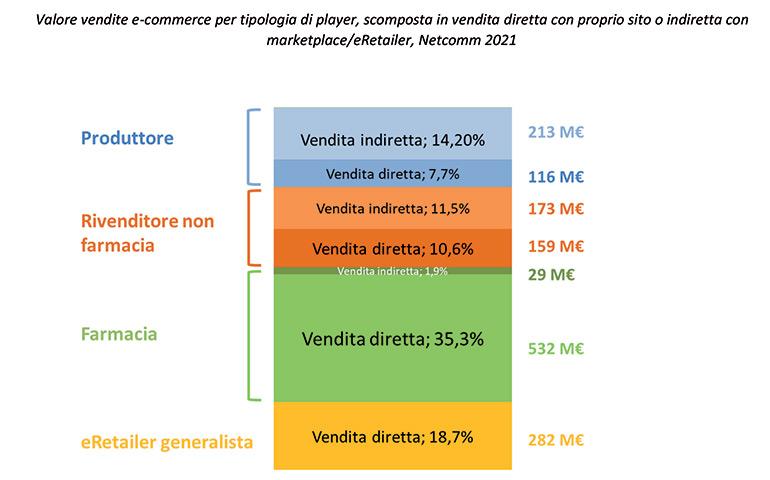

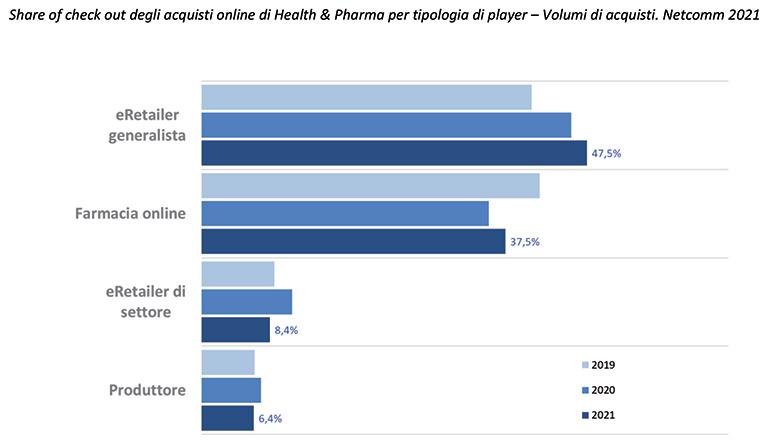

In 2021 it is the generalist e-retailers (Amazon, e-commerce of the GDO) and online pharmacies to hold the most substantial and growing market shares. According to the research, 8.4% of category purchases online are made on sites specializing in particular merchandise (contact lenses, optics, natural products, vitamins and supplements, parapharmacies, etc.), with manufacturers at the tail end (6.4%).

Pharmacies gain a few points (+2%) thanks to sales made through generalist e-retailers, while industry e-retailers (other than pharmacies) and manufacturers significantly increase their shares thanks to indirect sales through marketplaces (+11% and +15%, respectively).

Habits and preferences

Interest in all the services enabled by multichannel sales continues to grow and the one considered most useful is home delivery (54.5%); this is followed by online product booking and pick-up at a store or locker (39.7% and 41.3% respectively) and by phone, SMS or whatsapp (39.4%).

The idea of fully automated stores (where all stages of the buying process take place via display, without interaction with store staff) is considered an attractive option by one in three H&P online shoppers (37%).

The digital consumer is also accustomed to the latest generation of electronic payment methods. Eight out of 10 remote purchases (always of pharmaceuticals or health products) are paid for at the same time as the order with PayPal (34.3%), prepaid cards (23.9%) and credit cards (22.1%), while cash on delivery/collection payments are up 5%.

Digital for health goes beyond e-commerce

Looking at the healthcare system as a whole, it should be noted that the development of e-commerce in the healthcare sector is going hand in hand with the digitization of healthcare services.

“62% of purchasers of H&P products have booked online visits and other health services; 32% have used apps to manage health-related aspects and health paths; 29% have chatted with a specialist; 22% have made an online health consultation and over 60% of those interviewed believe that digital can make medical services and performances easier, faster and qualitatively better” commented Roberto Liscia, President of Netcomm.

Digital is therefore perceived by Italians as a real engine for improving healthcare. Citizens expect proximity care, home care and the possibility of being monitored remotely, and this drives many players in the sector to prepare skills, structures and services to allow access to these new methods of diagnosis and treatment.