Markets to explore: Latin America

In South America, the food & beverage sector drives domestic consumption and exports. Manufacturers’ attention toward protecting the environment, product authenticity and design is on the rise. In terms of packaging, Italy is the leading supplier country.

In South America, the food & beverage sector drives domestic consumption and exports. Manufacturers’ attention toward protecting the environment, product authenticity and design is on the rise. In terms of packaging, Italy is the leading supplier country.

Argentina participates in the global packaging market with a turnover of 4.6 billion USD. The country’s food & beverage sector is the largest user of packaging technologies (approximately 70%). Domestic production includes 81 packaging types and 91 types of machines, equipment and accessories. The industry comprises about 8,000 concerns, employing 30,000 workers to produce 1.3 billion packaging articles annually. Imports cover about 60% of national consumption. In 2014, Italy was the leading supplier, with a 43.7% share of the total.

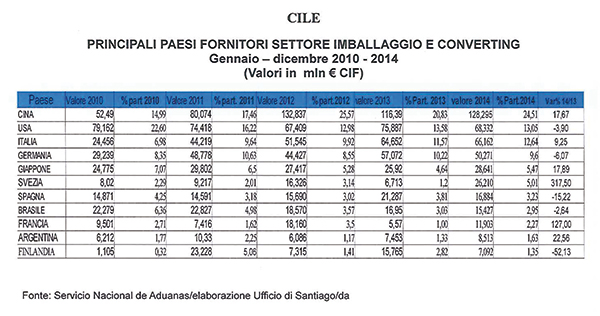

At the international level, Chile is recognized as a leading country (in both quantity and quality) in exports of fruit, produce and wines. The food sector ranks second in exports. More than 11,000 million dollars’ worth of agricultural products are exported, 2,600 million of which to Europe. The Chilean packaging user industry includes 600 manufacturers, employing about 22,000.

In 2014, total imports of packaging machinery reached 159.97 million euro, with Italy ranking first among major supplier countries.

Like other countries in the region, Chile is showing greater and greater attention to environmental protection and, in particular, to recycling packaging. The Chilean government is developing legislation to require the reuse, recovery and recycling, as well as more sustainable design of packaging (reducing). It follows that the concerns in the sector will have to bring their production in line with the new rules by acquiring new equipment or upgrading existing ones.

It’s worth keeping in mind, furthermore, that the as part of the accord between Chile and the European Union (2003), packaging machinery are exempted from customs duties (6% flat rate).

Peru is one of the world’s major producers and exporters of various fresh and preserved agricultural products that enjoy constantly growing demand, both domestically and abroad.

In particular, the country is seeing a gradual and responsive orientation toward certified organic products that comply with international norms and respect the environment, better guaranteeing the origin and processes behind “Made in Peru” products.

87% of enterprises are concentrated in Lima.The country also offers conspicuous opportunities to the graphics and converting sectors, considering its exceptional tendency to enhance products with quality packaging design, considered an irreplaceable marketing tool for promoting customer loyalty among both exporters and end consumers.

Italy has always held a strong position among Peru’s supplier countries, with a diversified offer based on a network of importers, agents and representatives with deep roots in the country and offering assistance from many locations.

Italian users who wish to read more about the “Country analyses” dealt with here, can contact the local offices of ICE that drew them up.

Main sector fairs 2016-17

Envase Alimentek (www.envase.org)

Tecnofidta (www.tecnofidta.com)

Argenplás (www.argenplas.com.ar)

Main sector fairs 2015

Espacio Food Service (espaciofoodservice.cl)

FullPlast 2015 (www.fullplast.cl)

Expo Food Process (www.foodprocess.cl)

Main sector fair 2015/2016

Expoalimentaria

www.expoalimentariaperu.com

Expoplast (expoplastperu.com)

The October issue features the last of a series of articles sponsored by ICE Agenzia and dedicated to global development opportunities and addressed to Italian packaging operators and converters. Following up on the in-depth look at Mexico featured in the June issue of ItaliaImballaggio, we now turn to Latin America, with an analysis of the Argentine, Chilean and Peruvian markets, which in the packaging field present numerous analogies.