E-commerce Italy: data and growth prospects

Netcomm Forum 2025: new projections of the B2C eCommerce market in Italy presented. Online purchases will rise to over €62 billion (+6%) with a base of 35.2 million digital consumers. Above-average increases recorded in the Food&Grocery and Beauty&Pharma segments.

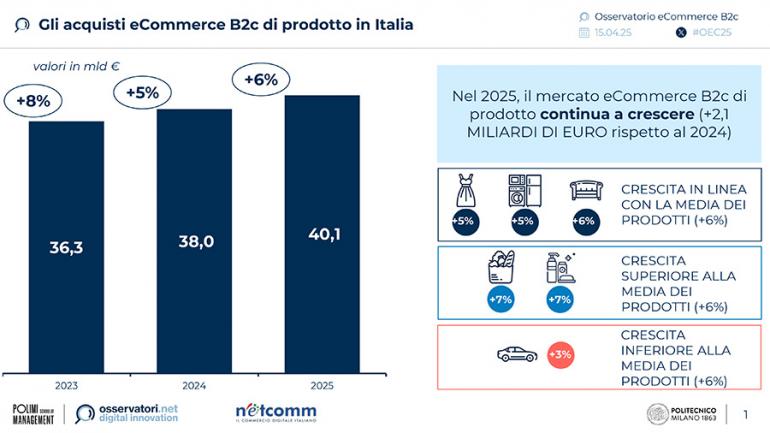

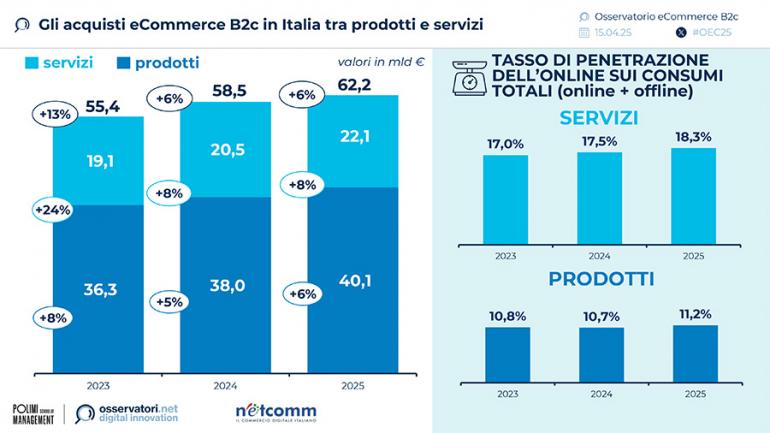

The B2C eCommerce race in Italy is proceeding well, albeit at a slower pace. The latest eCommerce B2C Observatory Netcomm – School of Management of the Polytechnic University of Milan predicts a 6% rise in the value of online purchases in 2025 compared to 2024, reaching more than €62 billion, of which €22 billion will be generated by services (+8% compared to 2024) and more than €40 billion by products (+6%). In the area of product purchases, the best performance is forecast in the Food&Grocery and Beauty&Pharma segments, with above-average increases (+7%), while Apparel, Computers & Consumer Electronics and Furniture & Home Living will experience growth in line with that of the sector (rates between +5% and +6%). Online penetration of total Retail purchases (online+offline) in products is 11.2%, half a percentage point higher than in 2024.

Dealing with complexity

The growth of the industry is taking place in a complex and ever-changing geopolitical environment. At the moment, uncertainty regarding the future is mainly due to the introduction of excise duties (currently frozen) by the United States, but another factor, explains Roberto Liscia, president of Netcomm, is the lack of effective digital strategies and the technological innovation necessary to compete in global markets. Although eCommerce is a key tool for boosting SME exports, more than 54% of Italian companies struggle to expand beyond national borders.

According to Liscia, in such a variable and uncertain scenario, skills become the real key to the future:

We are no longer talking only about technical or digital capabilities, but about a complex and integrated set of knowledge, attitudes, and behaviours that determine the ability to adapt, innovate, and generate value, and which will increasingly make a difference in organisations.

Increasing number of companies with their own e-commerce website

The number of Italian companies that have activated an e-commerce platform has increased by 3.4% since 2024, up to 91,000, with marked growth in corporations (+8.5%). The data highlight the maturation of the industry and the integration of advanced digital strategies. The main sectors involved are trade and services, with a strong presence in the Beverage, Publishing and Food segments. In terms of communication, 82.7% of companies have a social media presence, with Facebook and Instagram the most widely used channels. There is a strong rise in digitalisation, with 67.2% of companies showing a high level of ‘Digital Attitude’. However, more than 54% of enterprises still have a low level of internationalization, with the need to develop strategies to boost Made in Italy exports.

Social media: the main source of guidance for e-shopping

According to the Netcomm NetRetail 2025 report, which looks into the digital shopping behaviours of Italians and the prospects for omnichannel commerce in Italy, consumers shopping online in 2025 will reach 35.2 million (up 1.5 million from the previous year). Social media remains an important source of guidance for approximately one in four purchases (29.8%), along with point-of-sale and online retail media, while a slight decline is observed in push notifications. In addition, based on product category, specific preferences are observed: for example, the use of AI and chatbots plays a significant role in electronics and publishing, while offline retail media is more influential in the food sector.

Trends in online payments

Payment methods for online purchases in Italy are increasingly diverse (89% of transactions occur at the time of order). The main payment instruments are Digital Wallet (30.8%), credit card (26.4%) and prepaid on the website (23.6%). Consumers' expectations of online transactions mainly regard the security of transactions and the variety of payment options, with a growing demand for integrated and flexible solutions. Although the demand for security has decreased over the years, variety in payment methods has remained a priority for users.