Report on the state of packaging May 2024

Quarterly monitoring of the packaging supply chain: situation updated to May 2024. General economic situation and analysis of manufacturing activity and consequent evolution of the packaging sector.

Barbara Iascone

Italian Packaging Institute

Manufacturing industry data

In this part we summarise the trend of the manufacturing industry segments in which the consumption of packaging is more intense, subdivided into food and non-food macro areas. The evolutionary scenarios of the manufacturing sectors are taken from sectorial analyses developed by category associations, ISTAT and Prometeia, and using the Italian Packaging Institute’s data bank.

The following emerges for 2024 analysing the segmentation of manufacturing, and focusing on sectors more closely linked to the packaging industry. The food and beverages sector should see a reversal of the trend in 2023, with a growth of around +1%. On the basis of what emerges from the analyses of Cosmetica Italia’s research centre, the Cosmetics sector should achieve a growth of 9.8% in 2024, exceeding the values before the crisis in the Covid period.

The pharmaceutical sector should also confirm the positive trend already achieved in 2023, closing 2024 at +2%.

Consumer goods should close with +1.8% followed by the “fashion system” with + 0.8% and the furniture sector which should be substantially stable (+0.2%). The only sector falling is construction, which should shrink by around -1.8%

| var. % | var. % | var. % | |||||

|---|---|---|---|---|---|---|---|

| 2020 | 2021 | 21/20 | 2022 | 22/21 | Prec. 2023 | 23/22 | |

| Turnover (Mln euros - Estimate) | 33,256 | 35,216 | 5.90% | 40,652 | 15.40% | 40,710 | -1.20% |

| Number of employees (Estimate) | - | - | - | 109,491 | |||

| Number of companies (Estimate) | 7,257 | ||||||

| Production (t/000) | 17,002 | 18,194 | 7.00% | 18,089 | -0.60% | 17,500 | -3.30% |

| Export (t/000) | 2,846 | 3,029 | 6.40% | 2,961 | -2.20% | 2,627 | -11.30% |

| Import (t/000) | 2,091 | 2,419 | 15.70% | 2,694 | 11.40% | 2,651 | -1.60% |

| Apparent use (t/000) | 16,247 | 17,583 | 8.20% | 17,822 | 1.40% | 17,524 | -1.70% |

The packaging sector: provisional figures

At the time of drawing up this analysis, the data referring to 2023 are still being processed; we can only, therefore, provide provisional results. Production should show a fall of 3.5%, perfectly in line with the trend of the manufacturing industry (-2.3% in 2023). Turnover is also down, albeit to a lesser extent than production, -1.5% on 2022.

It is worth highlighting the trend in foreign trade, which sees imports overtake exports, making the trade balance negative for the first time: there were around 24,000 tonnes more imports than exports.

Both imports and exports show a negative trend, but the first to a decidedly lesser degree, -1.6% against -11.3% of exports.

Use of packaging in 2023

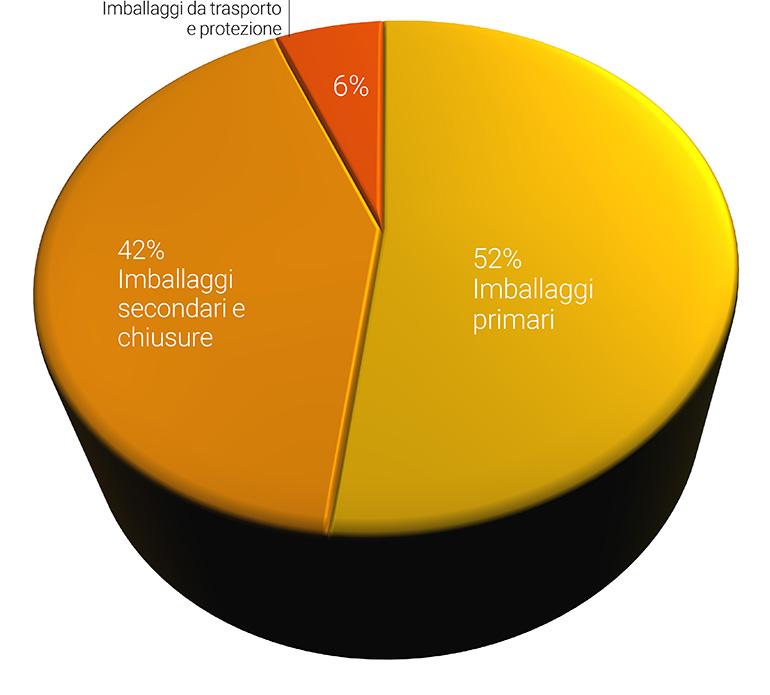

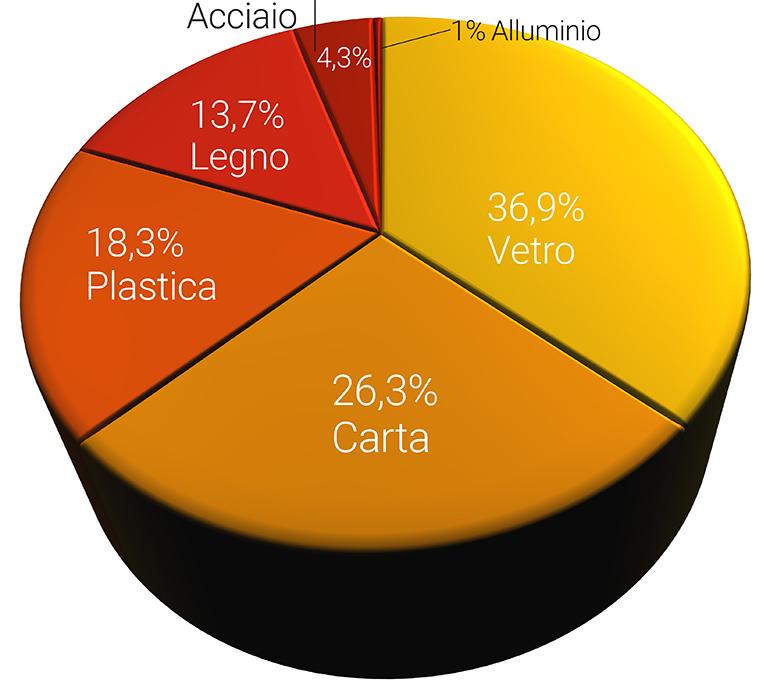

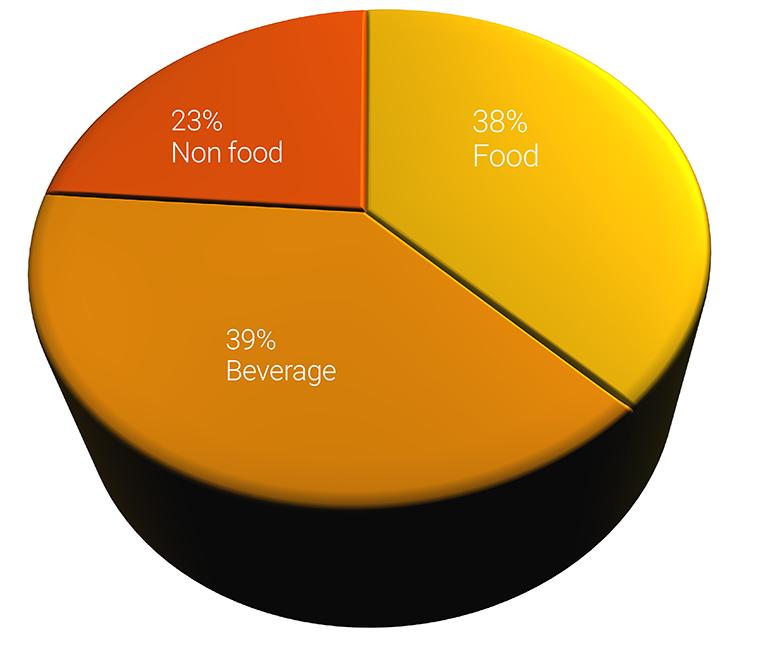

In 2023, around 12,700,000 tonnes of packaging were used in Italy. Of these, 52% relate to primary packaging and 42% to transport and protection; the remaining 6% represent secondary packaging ad closures. 77% is intended for the food sector, including beverages, and 23% to non-food. Analysing once more the tonnes of packaging used, around 36.9% is represented by glass packaging (it should be taken into consideration, however, that, being a heavier material, its importance is somewhat exaggerated). 26.2% is represented by paper and cardboard packaging, while plastic packaging (including flexible poly-laminates) follows with 18.3%. For both, in this case, we have an underestimation of the market share, as they are among the lightest materials and are widely present in the packaging of a vast range of products.

We have, finally, with 13.7%, wooden packaging, linked almost exclusively to the world of transport, followed by steel packaging at 4.3% and aluminium packaging at 0.5%

GENERAL ECONOMIC SITUATION

The first results of an analysis of the economic situation in the first quarter of 2024 shows a situation of recovery but only for a part of the Italian economic system. • On this basis of the analyses of Confindustria’s research centre, Italy’s GDP in the first quarter showed +0.3% despite, however, a contraction in both industrial production and the consumption of goods. Italy’s GDP trend is perfectly in line with that of the eurozone as a whole, which also has a growth of +0.3%. There are positive trends with respect to tourism and services, as well as to the trade balance. The confidence of both enterprises and families is, on the other hand, falling. Internal demand is decreasing, particular for the consumption of goods, with a trend confirmed by a fall in retail sales in March (-0.4% in the first quarter of 2024). The decreasing trend of industrial production is confirmed by a slight drop in the movement of inventories of goods. Imports also fell in the first quarter, showing a -2.8% by volume, to a decidedly greater extent, however, than that for exports, -0,8%, giving rise to a positive trade balance. • The latest data analysed by Prometeia show a recovery for manufacturing production: the forecast is +0.6% on an annual basis; a more dynamic trend is expected in the second half-year of 2024, which should mean a potential recovery of the losses recorded in 2023. On the basis of Prometeia’s analysis, after a first negative quarter and in line with a weak 2023, the Italian economic trend should take a positive turn. Exports will contribute to this recovery, confirmed by a growth in global demand. The export trends are positive both towards countries outside the EU, in particular the United States, and in the context of the EU, which in 2023 underwent a slowdown; growth should reach +2.6% on an annual basis. Slowing down the manufacturing trend for 2024 will be, most of all, investments in construction; with the effects of the “post covid” incentives fizzling out, the sector is showing signs of contraction. Supporting internal demand, Prometeia confirms, will be services, first and foremost those linked to tourism, but also the auto sector, both insignificant, however, for the packaging industry. The food sector is substantially stable, having shown signs of weakness in 2023. The increase in prices and the drop in families’ spending power will reduce the possibilities for a recovery in other sectors, like the fashion world.