Cellulose packaging – Data 2013

During the course of 2013, the Italian and European economies continued to undergo a recession that has shown signs of improvement only in the last two months. On the basis of Istat data processed by Assografici’s research center, the graphics industry (to which cellulosic packaging belongs) saw negative growth compared to 2012: -11.7% production and -7% turnover. The sector in Italy. Plinio Iascone

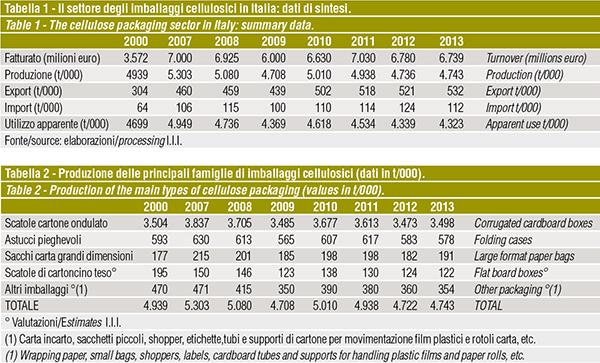

The Italian paper industry, in the sector of “paper and board packaging”, experienced a 0.4% drop in production in 2013, while in monetary terms, its turnover dropped slightly by -0.6%.

Cellulose packaging continues to play an essential role in product packaging and handling, both as primary and as presentation packaging: 33% of all Italian production of packaging is made up of cellulose, of which corrugated cardboard represents 24%.

Italy’s paper industry occupies a high place in the European ranking (third).

In 2013, production of cellulose packaging was reported to be 4,743 t/000 (values mostly equal to 2012, which however represented a progressive decline from 2011 and 2010). Domestic demand has also been confirmed to have remained stable compared to the previous year, while exports increased by 2%, and imports fell.

Industry final balance data

The paper and board packaging sector includes a wide variety of packaging types: corrugated cardboard boxes, folding board cases, large format paper bags, shopper bags, bags, cellulose containers, medium/high thickness paperboard boxes, laminated paperboard containers, wrapping paper, cardboard tubes, etc.

The main sector, in terms of production, is corrugated cardboard, which, thanks to the use of this packaging in transport, allows for a wide range of applications; the next most important is folding boxes. In terms of weight, production of cellulose packaging is structured as follows: 73.8% corrugated cardboard, 14.8% folding boxes and flat board boxes, 4% high capacity bags, 7.4% other.

Corrugated cardboard. In 2013, production of corrugated cardboard packaging equaled 3,498 t/000, a slight increase over 2012 (thanks to the early signs of recovery from the recession during the fourth quarter).

Both exports and domestic demand made a slight recovery.

According to information from the database of Istituto Italiano Imballaggio, corrugated cardboard packaging is used: in the food and beverage sector (43%), excluding garden fresh fruit and vegetables (14.5%); handling in the furniture sector (12.9%); and the remaining 20.6% concerns a variety of areas (chemical products, electronics, electric home appliances, construction products, etc.).

Cases and boxes. This area can be divided into two main sectors: folding cases (82.6%) and flat board boxes (17.4%) . Approximately 52% of folding boxes are made from 100% cardboard, while the remaining 48% represents containers laminated with PE or aluminium film (the market share is stable but with high potential for growth). Lamination with plastic or aluminium film is generally required in order to give the box a particular high class look, or for specific needs having to do with its use.

In total, in 2013 production was 700 t/000, -1% less than the previous year. The general decline can be attributed to a drop in both domestic demand and exports.

In terms of destination, cases and boxes are distributed as follows: 45.9% for food, 18.2% for beverages (mostly clusters), 9.8% for cosmetics and pharmaceuticals and 26.1% other non-food. In particular for boxes, their main users are the footwear, leather and clothing industries (with a total share of approximately 56%).

Large format paper bags. The heavy recession of the construction sector, the main outlet area of bags (62% of sales), has had an enormous influence on the progress of the sector. Following a halt to production growth in 2011, and an 8% drop in 2012, the industry ended the year with a positive turnaround, reporting +5%, driven by exports, which grew by 14%.

Domestic consumption also interrupted the negative cycle after two years of decline, returning to 2012 values.

Other packaging The other “families” of cellulose packaging are: shopper bags, cardboard tube packaging and accessories, wrapping paper (parchment, laminated and plain), paper sheet supports for clothing, protective micro-corrugated sheets, small bags and cellulose containers.

In 2012, total production of this sector was estimated at around 355 t/000, -5% compared to 2011, and in 2013 it recorded a further decline of 1.4%.

The decline was mainly due to wrapping paper, corrugated sheets, display cases and shoppers, while cellulose tubes re-confirmed 2012 values.

Plinio Iascone

Istituto Italiano Imballaggio