In search of well-being

The photograph presented by the Coop 2024 Report – Consumption and lifestyles of Italians today and tomorrow – shows how the holistic dimension of food continues to prevail in Italians’ purchasing decisions, also with a view to environmental wellbeing. Store brands and discount stores dominate. Packaging has a central role in the sustainability paradigm.

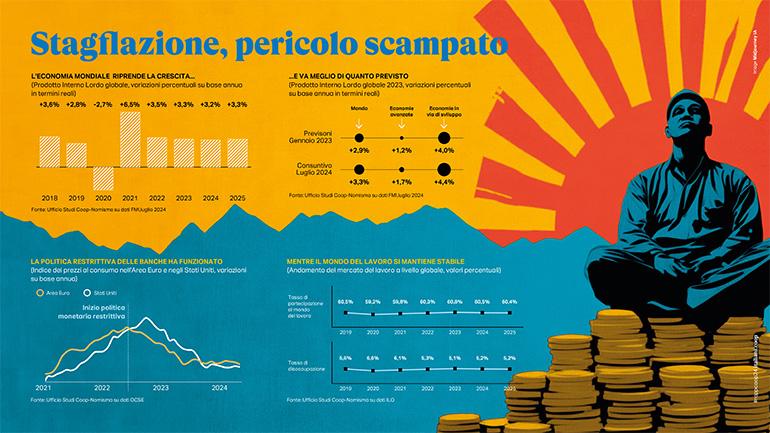

After a complicated year of fluctuating trends and international crises, the global economy has returned to growth (+3.2% in 2024 and +3.3% in 2025), avoiding the risk of stagflation feared by many economists. Europa appears to be in greater difficulty than North America, but it is above all the emerging economies that are taking on an increasingly prominent role: India, with an expected growth of 7% in 2024 and 6.5% in 2025, is gearing up to take on the role by 2027 of a new global economic locomotive, immediately behind the giants China and the United States. In this scenario, Italy has demonstrated considerable resilience and, a little surprisingly, records economic growth above other European countries, sustained most of all by a renewed exuberance of exports and finally pro-cyclical fiscal policies.

The uneasy Bel Paese

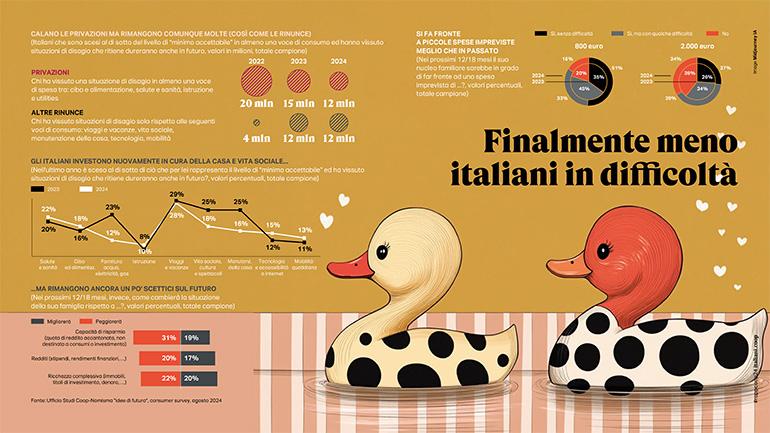

The economic recovery is not enough, however, to reassure Italians. The photograph presented by the Coop 2024 Report is that of an uneasy country, in which the share of people looking to the future with confidence has fallen (dropping 4 points in two years) and apprehension has increased (2024 +11 points against 2022). It’s an underlying anxiety, generated by the fact that the majority of Italians (55%) are grappling with a life very different from their initial expectations, very often in a pejorative sense (44% of the sample). While it’s true that purchasing power has recovered to pre-pandemic levels and that with respect to the past today there are fewer Italians today who have experienced situations of profound hardship (20 million people admitted to this in 2022 compared to 12 million today), the country’s social difficulties, however, remain extensive.

New consumption rules

Having gone through difficult years of inflation, Italians are returning with caution to increasing their food consumption and are attributing new and complex meanings to food. Spending remains frugal and careful, less sensitive to the intangible contents of brands, and marked by sober choices and a reduction of the superfluous. At the same time, food remains central to Italians’ personal and collective identity and is constantly enriched with new attributes: an inclination for low-calorie, personalised, healthy and sports diets, renouncing meat and looking for possible protein substitutes. More generally, diets oriented towards personal wellbeing and that of the planet predominate. Starting from the Italian tradition, Italians are exploring new eating styles creating a difficult challenge for operators in the food supply chain.

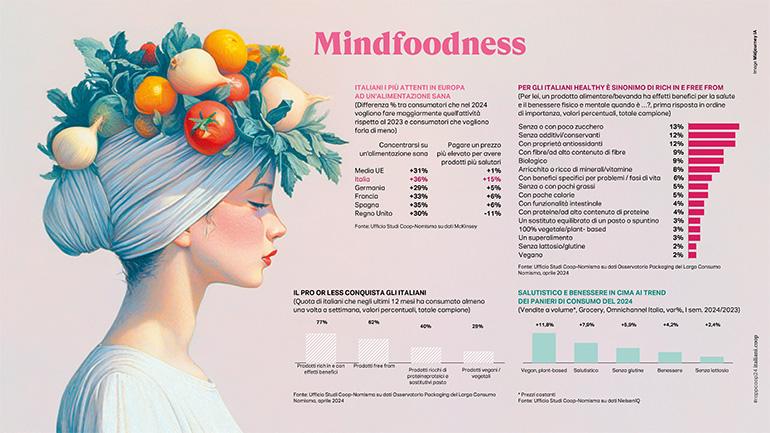

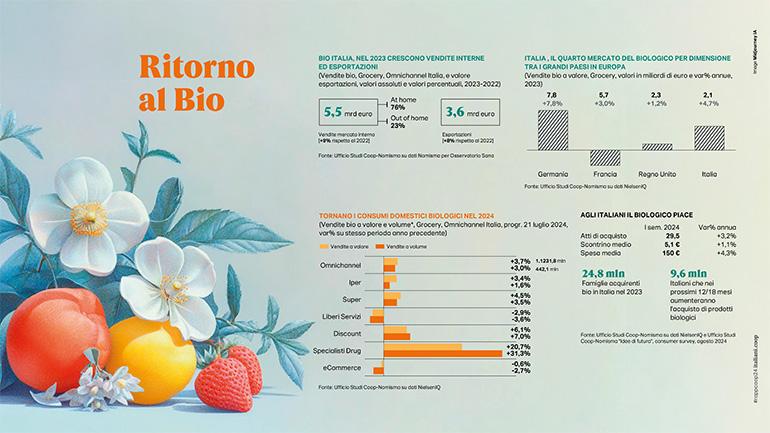

Mens sana in corpore sano

The intrinsic link between both physical and mental well-being and conscious nutrition, so-called “mindful eating”, is capturing the interest of an increasing number of Italians. Over three quarters of the population, in fact, chooses on a weekly basis foods rich in beneficial substances, while over six consumers out of ten regularly opt for “free from” products; at the same time, also high-protein products (+2% against 2023) such as vegan, vegetable and sport fitness products, are gaining ground. Interest is growing in organic products, considered an informed choice that combines quality, food safety and respect for the ecosystem. According to the “Ideas for the future” survey carried out by the Coop’s Research Centre in collaboration with Nomisma, there are 4.8 million Italians that follow a predominantly organic diet, and 9.6 million intending to buy organic products in the future.

Packaging: certifications and supply chain for a sustainable product

For consumers, food sustainability is seen not only as greater attention to healthy and low environment-impact foods, but also greater awareness of waste and a preference for reduced and recyclable packaging. Nomismas’s Packaging and Mass Consumption Monitoring Centre data indicate that sustainability plays an important role in the lives of six consumers out of ten: 29% even assign it a central role, describing it as the element that most affects their behavioural and purchasing choices. In addition, there are aspects linked to product traceability, to local production and social sustainability, which guarantees the respect of workers’ rights and a fair price along the entire supply chain

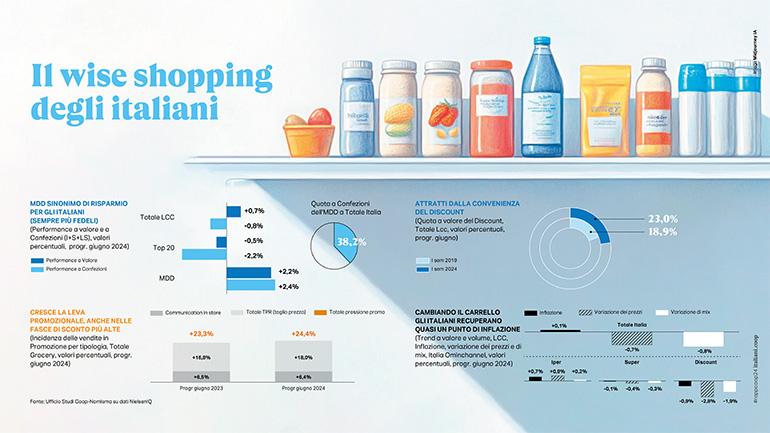

Store brands and discount stores are the main savings drivers

In the first half of 2024, store brands have consolidated their position in the Italian market, adding 38.2% of total market sales by volume, with an increase of 2.2% by value and 2.4% by volume compared to the same period in 2023, against a brand product variation (TOP 20) of -0.5% by value and -2.2% by volume. Italians’ trust in store brands is such that 78% of managers in the Food & Beverage sector expect this brand type to become the top performer in the next 12-18 months. In the same way, the growth of discount stores continues, also thanks to a continuous expansion of the sale network, reaching 23% of market share, with an increase of around 4 percentage points compared to 2019.

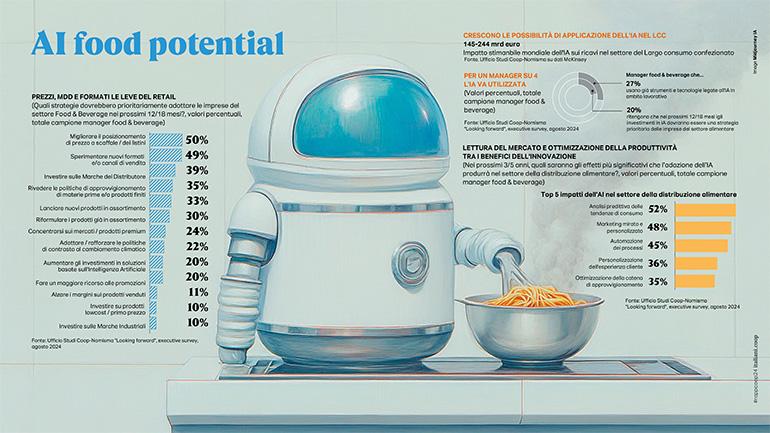

Future trajectories of the food supply chain

2023 was a turning point for the Italian food supply chain, with positive signals which are reflected both on large-scale distribution and on the food industry. In detail, large-scale distribution has reached a net turnover of over 81 billion euros, showing an increase of 8.4 percent compared to 74.8 billion recorded in 2022, while the food industry has seen an increase in turnover of 7%, moving from 75.9 billion euros in 2022 to 81.2 billion in 2023. Investments are gradually returning to pre-pandemic levels, while, according to 60% of managers, a significant increase in artificial intelligence at global level is expected. Specifically, 20% of managers in the food & beverage sector affirm that AI-based solutions are already being used. In addition, over one manager in five recognises the importance of its adoption and forecasts that, in the next 12-18 months investments in AI should be a priority strategy for food sector businesses, with the aim of improving operating efficiency, reducing costs and offering more customisation to customers to boost their loyalty.