Flexible packaging

Made with different laminated materials - cellulose, plastic, aluminium films, metallized - or from the coupling of a single material, even in times of general recession, the packaging area represented by flexible converter packaging has always featured positive growth. And this thanks in particular to its ductility that makes it ideal for packaging a variety of products, and its being competitive to other materials.

On the market they are widespread in the form of pouches, of films for the closure of trays, cheerpacks with closure (very similar to the packaging used in the context of domestic detergents or in cosmetics for stand-up refills). There are also trays made with materials whose thickness is below 200 microns, intended for fruit and vegetables or ready meals.

Raw materials for the production of converter flexible packaging

A progressive lightening of the flexible packaging is underway, highlighted also by the examination of the mix of raw materials used for the production of the laminates.

In terms of weight, the raw materials destined for the production of flexible converter packaging in 2018 was slightly down overall. In detail, there is a certain stability in the use of paper, cardboard and Nylon; other plastics fell by 2%, aluminium by 0.3%.

The Italian market

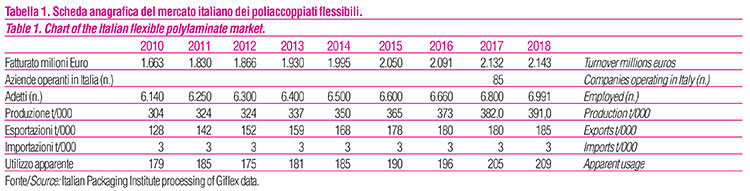

Something the sector is able to be proud of, employment levels have always been positive; the number of employees has in fact grown even in the darkest moments of the Italian economy, representing a spearhead for Italian industry. The year 2018 continued to witness an increase in the number of employed, by 2.8%.

There are around 85 companies operating in Italy in this sector.

In 2018 production reached 391,100 t (+ 2.5% compared to the previous year), with exports up 3%, driving sector growth: exports therefore remain an important component for the sector, strengthened by the excellent quality of the product offered and a highly customer-oriented service. In 2018 exports accounted for around 47% of production, registering positive trends not only for “empty” exported packaging, but also for “full” packaging.

Indeed flexible converter packaging features in many sectors in which Italy is a good exporter: this is the case of coffee, cheese, pasta and baked goods, pet food, convenience fruit and vegetable products.

Domestic demand also grew by 2%, while imports were stable.

As shown in Table 1, in 2018 global sales reached 2,143 million euros (+2.5% compared to 2017).

Analysing the market from 2010 to today, production was supported by an average annual growth rate of 3.6%; on a par with turnover.

With regard to the subdivision of the type of laminated materials, according to the analysis of the Italian Packaging Institute, 73% of the flexible converter polylaminates are made up of mainly plastic polylaminates, 25% are predominantly paper, those predominantly in aluminium account for the remaining 2%.

Sectors of use

Sectors of use

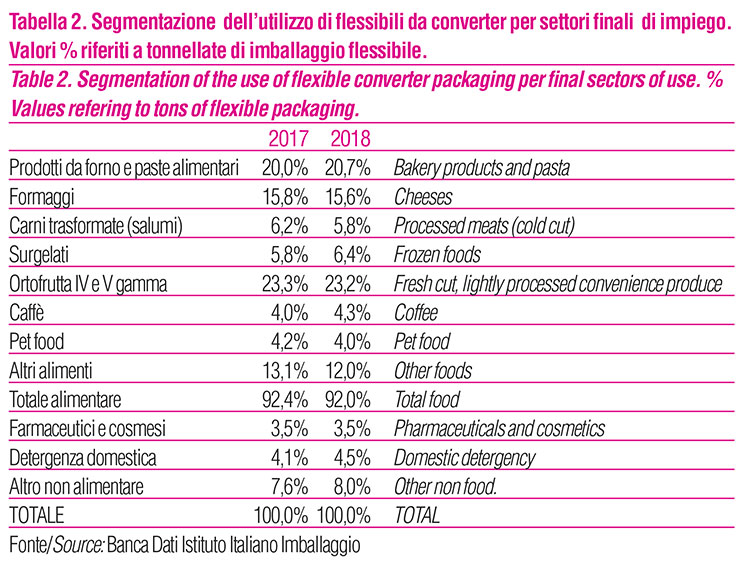

The food area remains the main outlet market for flexible polylaminate packaging: even if slightly down compared to 2017, participation is in fact 92%.

Figures are boosted by the strong effect of convenience foods – enjoying ever greater popularity (in 2018, their growth rate was 6%).

In 2018, the use of this type of packaging also increased in the frozen food sector, as well as in that of pasta and bakery products, where biodegradable/compostable materials are also being introduced. There is also an increase in the use of flexible packaging in the coffee area, following the intensification of consumption outside the home: in 2018, the consumption of coffee at bars grew, using mixtures packaged in flexible polylaminate bags or in steel tins.

Below are the percentages registered in 2018 in the food area for the various sectors of use of flexible packaging:

- area of bakery products and pasta 20.7%;

- convenience fresh-cut and fresh-cut, lightly processed fruit and vegetable products 23.2%; in this context, there is a slight drop in fruit and vegetables, not so much attributable to the loss of position of packaged products in flexible packaging, but rather to a general decrease in consumption;

- cheeses 15.6%.

Going into more detail, we report the market shares of flexible packaging for individual food products:

- processed and cured meats 5.8%, with a loss essentially due to a drop in consumption of these products;

- frozen foods 6.4%;

- coffee 4.3%;

- pet food 4%, which shows increase in both dry and wet products.

- other foods 12%, down compared to 2017. This listing includes sauces, ready meals, fish products, sweets and confectionery in general, baby food, yogurt, spices, olives for consumption, honey, tomato derivatives, fresh meat, drinks, condiments, spices, etc. (table 2).

In the beverage sector, the use of flexible packaging in cheerpack production is growing, a type of packaging that, year after year, is undermining the single-dose brik. In 2018, the percentage of cheerpacks in the fruit juice packaging mix increased by around 1.5%.

In the non-food area, the domestic detergent sector showed a share of 4.5%, followed by pharmaceutical and cosmetics-perfumery, both with a share of 3.5%.

For both domestic and personal care products, the phenomenon already registered in recent years is confirmed, whereby refills are becoming increasingly popular: flexible, cheap and light, they are growing at the expense of plastic bottles.

In these two areas, the other phenomenon in constant evolution is that of single-dose packs: almost always these are sachets made of flexible converter material, such as cosmetics samples or cream or granule medicinal product packs.

The absolute novelty of the last few years is the lamination of biodegradable and compostable materials: paper + plastic but also plastic + plastic, to obtain low environmental impact packaging.

These are “eco-friendly” solutions, which, however present some limits of technical weldabililty, especially for plastic+biodegradable/compostable plastic laminates, which have a consequently limited use.

As for the flexible plastic + biodegradable/compostable plastic polylaminates, they can be used to package food products with a short shelf life; this is the case of fresh baked goods, made at the point of sale or in the immediate vicinity (fresh bread, breadsticks, focaccia, but also pastry products such as brioche and croissants).

As regards the paper + biodegradable/compostable plastic material, the main sector of use is industrial dry pasta: thanks to the paper element, the packs can in fact be satisfactorily welded, guaranteeing the correct conservation of the contents.

Based on a quantitative analysis carried out by the Italian Packaging Institute, the production for 2018 is estimated to be around 10,000 tons.

What are the challenges for the future?

What are the challenges for the future?

According to Flexible Packaging Europe - the association that brings together flexible packaging manufacturers in Europe and of which Giflex is also a member - the watchword for the immediate tomorrow is “Sustainability”: a concept that extends to the entire supply chain, from the raw material to the manufacturers of packaging machines to the users and distributors. The goal is to recover the totality of the packs by 2025. The project does not only include working on the technologies of the material which, at present, consists of the lamination of three different types of material, but also aims to be able to develop infrastructures capable of collecting, separating and recycling flexible packaging in Europe.

«Flexible packaging is obtained by converting plastic films, thin paper-based materials, cellulose and thin aluminium sheets used as primary and/or secondary packaging which, once filled with food products and closed, under normal conditions, acquire a flexible form. The choice of the specific materials used is determined according to the properties and the specific needs that the packaging must satisfy, particularly in terms of the perishability and shelf life of the product».

This is what we read in a statement, published by Giflex the Italian association of flexible gravure and flexographic printed packaging manufacturers, in 2016, which summarizes the nature of this type of packaging.

Barbara Iascone

Istituto Italiano Imballaggio