Flexible Packaging: economy, trends and public policies

Sustainability as a lever of development for restarting: Giflex 2021 marks the line in a “virtual”, though very concrete, public meeting, animated by stimulating talks that well frame a complex and evolving situation. .

Edited by Maria Costanza Candi

Held on January 19, the webinar “Giflex 2021, Scenarios for the Restart” was an opportunity to present the new presidency, offer an overview of the program objectives for the next two years and frame the complex context in which it will develop, with a health situation still in serious emergency and a market to be interpreted, between national and European regulatory interventions, support funds and public policies.

Institutional speeches by the new President Alberto Palaveri (CEO of Sacchital) and Italo Vailati as Secretary General of the association that brings together manufacturers of flexible packaging printed in rotogravure and flexography were complemented by a number of wide-ranging reflections that offered interesting interpretations of the international scene, including the economy, trends and public policies.

Actions for the competitiveness of the sector

Sustainability, circular economy and recycling as accelerators of the sector’s competitiveness: these are the basic themes of Giflex’s strategy for the next few years, focused on making plastic, and packaging in general, a resource rather than waste. Circularity therefore, even at the end of the product life cycle, combined with sustainability of the entire production process, to make the sector a point of reference on the philosophy of the “three R’s” - reduce, reuse, recycle - in a view where the quality of packaging is central.

A qualitative effort that the flexible packaging sector is making, which institutions must acknowledge, responding with complete regulations, shared with the sectors involved. A virtuous practice that, however, requires certainty in terms of times and methods so as not to become a further obstacle in an already difficult period (as underlined by Palaveri).

Reading the present to direct change

That’s why Giflex wanted to bring together experts close to the policies of the Government, the European Union and economists of international standing, who offered important keys to interpreting the changes taking place, in a succession of coherent talks of which we report ample excerpts.

• Filomena Maggino, President of the Cabina di Regia Benessere Italia, explained the action related to the 5 macro strategic areas chosen to integrate and guide the sustainable component of government policies: fair-sustainable regeneration of territories, mobility and territorial cohesion, energy transition, quality of life and circular economy, the latter in particular, the focus of Giflex action.

• These themes are part of a complex economic framework where “an innovative vision will be essential to guide the restart”. This is what Fadi Hassam, economist at the Bank of Italy and lecturer at the London School of Economics, said.

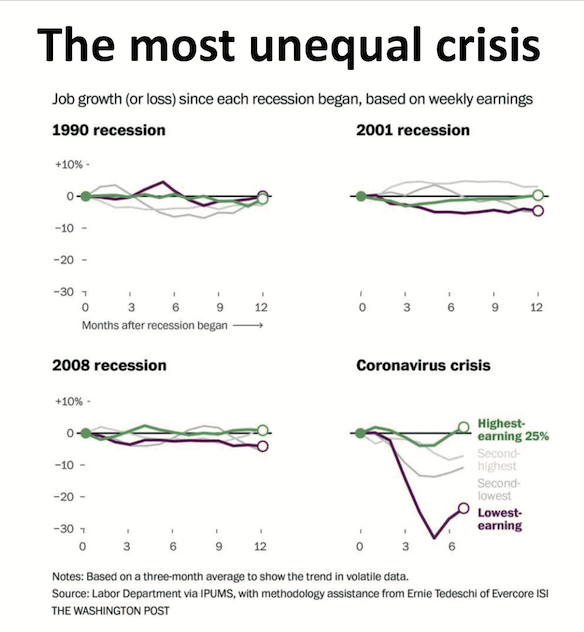

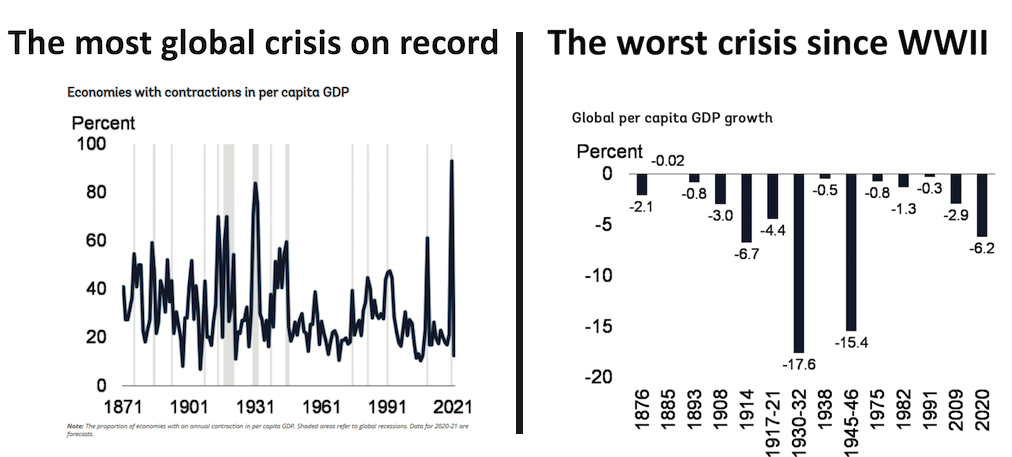

Hassam offered a picture of what he defines as a “global crisis”, with GDP. falling by around 10% and a 5% rebound expected in 2021. The worst crisis since World War II, well beyond that of 2008, globalized as never before in history. Never before, in fact, have so many countries been in crisis at the same time and with such high degrees of inequality with respect to the trend of wages; an item that cannot but have an impact on large-scale consumption and the world of packaging.

Governments have therefore reacted with fiscal policies and an increase in public debt, well above post-World War II debt levels. Also unsurpassed is the amount of funds coming in, with various management strategies ranging from support to companies with bank guarantees and liquidity, to direct transfers to current accounts, as occurred in Germany. Indebtedness is therefore very high, higher than in the 2008 crisis, but with a net value that takes into account the liquidity of companies, which makes the situation less serious in terms of investment capacity for restarting, particularly in manufacturing.

Governments have therefore reacted with fiscal policies and an increase in public debt, well above post-World War II debt levels. Also unsurpassed is the amount of funds coming in, with various management strategies ranging from support to companies with bank guarantees and liquidity, to direct transfers to current accounts, as occurred in Germany. Indebtedness is therefore very high, higher than in the 2008 crisis, but with a net value that takes into account the liquidity of companies, which makes the situation less serious in terms of investment capacity for restarting, particularly in manufacturing.

Also on the consumer front, the economist points out, household debt goes hand in hand with savings that, in some quarters, have even doubled as in Germany and, in general, in the Eurozone. Liquidity available for when families find confidence and therefore return to consumption, despite a growth in inequality between higher incomes and impossible savings capacity for lower ones.

Looking at the international picture, the protagonists are the central banks, with the ECB holding public securities for 150 billion euros as part of the Asset Purchase Programmes. Of these, 20% are Italian, well in excess of the 13% due, equivalent to our country’s contribution to the bank itself.

On the globalization front, the drop in world trade presents heterogeneous data that see Europe and North America in serious crisis with Asia holding firm. A heterogeneity that is not only geographical but also sectoral, where electronics and pharmaceuticals are growing, while textiles and automotive are in great difficulty, also due to trade disputes between China and the USA, on which the change of direction of the new Biden presidency hangs.

This is one of the many indicators of the impact of Covid on globalization, with the EU-China Comprehensive Agreement on Investment, the most important trade treaty between the two countries in recent years, shifting the axis of relations, distancing Europe from the United States. A geopolitical arrangement that may also have an impact on the geography of production, which could move from East Asia to the southern Mediterranean: textiles in Turkey, sportswear in Jordan and automotive in Eastern Europe.

Finally, looking back at Italy, we cannot fail to mention the now organic crisis of productivity, similar, according to Hassam, to that of the 1960s. The reasons lie in the inability to react to the changes of the ‘90s, with the growth of Asian markets and globalization that would have imposed innovation, R&D and digitization on which Italy has instead lagged behind, but also on the managerial attitude to reward seniority, distributing horizontal awards without giving value to merit and thus removing the talent needed to revolutionize the system. In short, in a 1.0 world Italy excelled, while in 2.0 it lagged behind, but the pandemic could push for genuine change.

• Also at the European level, the health crisis has led to the strengthening of the trajectories already defined by the Green Deal launched by the Commission as part of the Next Generation EU action, which today, with the Recovery Fund, assumes the role of accelerator of innovation, on fronts ranging from environmental issues to social cohesion, from the digitalization of all sectors of society to industry. Patrizia Toia - Vice-President of the European Parliament’s Committee on Industry, Research and Energy - spoke about this, promoting a specific proposal dedicated to chemical recycling, transferring the concepts of the circular economy to a sector less at the center of the debate in this sense.

For the European Commission, with the European Innovation Council, the chemical industry becomes central also in the logic of R&D, with a share of the 90 billion foreseen by Horizon, channelled to the best research projects in this specific field. The objective is to create industrial ecosystems capable of embracing the entire supply chain, including waste also in the chemical sector. The circular economy thus becomes an asset of the recovery plan, which envisages a specific fund able to activate circularity initiatives of production systems, technological hubs and territorial competence centers, focused on the theme of regeneration, end-of-cycle management and re-entry into the supply chain.

• And it is with the closing reflection of the “Giflex Foreign Minister”, past president Michele Guala, that the regulatory node is pointed out, fundamental for the flexible packaging sector, which speaks of European and not national production.

An international character that is in contrast with the system of national or even local rules, where individual municipalities, throughout Europe, make different strategic choices for the management of circularity processes. That’s why for Giflex, having a harmonization of the regulations related to the supply chain, to recycling, including chemical recycling, can make the difference for the development of the sector. The management of the end of life of plastic and composite materials becomes the engine of technological innovation and enhancement of environmental issues at EU system level, also thanks to an active involvement of the association as a stakeholder and interest group.