Flexible packaging: effective and innovative

An overview of what is defined as “complex structure packaging”. We here present production and turnover data for 2023 in Italy, analysed in July 2024.

In the vast world of packaging, converted flexible packaging is the youngest and most innovative type present on the food market and other markets, characterised, besides for its very high technological content, by ductility and lightness.

Various types of materials are used to produce flexible packaging: plastic film, paper or aluminium are used in this context because they offer significant advantages in terms of weight reduction and for their capacity to create tailored products for different applications.

Flexible packaging is produced by extrusion or lamination; depending on the number of materials used, it can give rise to mono-material or multilayer materials. In addition, every component performs a specific function, and, for this reason, is considered as complex structure packaging.

There are elements that have the task of maintaining the fragrance of the product, others that serve to prolong the product’s shelf-life, and others again that are used to guarantee an improved barrier effect. With regards to plastic film, polyethylene and polypropylene are mainly used; in the last few years, polymers coming from recycling and biodegradable have been increasingly used. Other materials used are paper and aluminium or paper and biodegradable plastics.

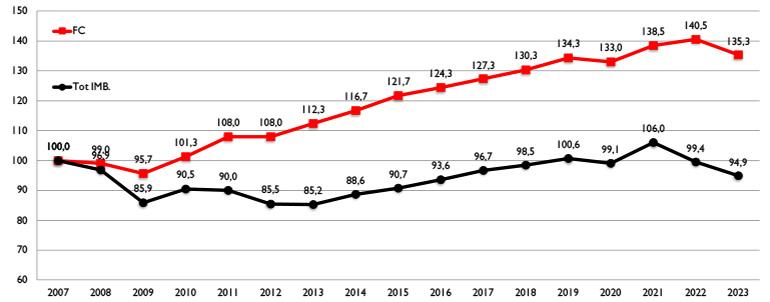

With these characteristics, flexible packaging is in a phase of great expansion; in the last sixteen years, with regards to Italian production, the sector has experienced an annual average growth of +1.8%.

| 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|

| Turnover (millions of Euros) | 2,227 | 2,227 | 2,822 | 2,780 |

| Companies operating in Italy (approx.) | - | - | - | 80 |

| Workers (approx.) | - | - | - | 7,130 |

| Production t/000 | 399 | 415 | 421 | 406 |

| Export t/000 | 219 | 216 | 227 | 219 |

| Import t/000 | 3 | 3 | 3 | 3 |

| Apparent use | 183 | 202 | 197 | 190 |

The situation in Italy

In 2023, production expressed in tonnes amounted to 405,800 tonnes; the fall of 3.7% was mainly caused by the negative trend in the food sector. Exports accounted for 54% of production, while imports, historically low, were stable at around 3,000 tonnes.

The domestic market is represented by an apparent use, that is to say, one that does not take account of stock movements, which is down -3,6%, arriving at around 189,700 tonnes. The turnover of the sector in 2023 was around 2.78 billion euros, down compared to the previous year by 1.5%, a drop that can be mainly attributed to a physiological rebound, after the +19% recorded in 2022. As was the case for the entire packaging sector, production and turnover trends are aligned with historical ones.

Converted flexible packaging is classified on the basis of the prevalence of the material used: 73% predominantly plastic, 25% paper, the remaining 2% aluminium.

| 2022 | 2023 | |

|---|---|---|

| Bakery products and pasta | 20.10% | 19.80% |

| Cheeses | 24.40% | 24.70% |

| Processed meats (cold meats) | 4.50% | 4.40% |

| Frozen foods | 4.10% | 4.00% |

| IV and V range fruit and vegetables | 26.40% | 26.80% |

| Coffee | 3.90% | 3.80% |

| Pet food | 0.90% | 0.70% |

| Other foods | 10.40% | 10.30% |

| Total food | 94.70% | 94.50% |

| Pharmaceuticals and cosmetics | 2.80% | 2.90% |

| Household cleaning | 2.50% | 2.60% |

| Other non-food | 5.30% | 5.50% |

| Total | 100% | 100% |

Use sectors

94.5% of converted flexible packaging is used in the food sector, although its use in non-food sectors, especially cosmetics, where it is used for containers for refilling soaps, body wash and shampoos, is also gaining ground.

- Going into more detail, the food sector can be subdivided as follows: Firstly, fruit and vegetables, with packaging for the IV, V and VI classes, accounting in 2023 for 26.8% of the total. In second place we find the cheeses category, with a share of 24.7%; these are followed by baked goods and pasta which, together, cover 19.8% of the sector. Other types of foods follow at a certain distance: with a share of 4.4% we have cold meats, followed by deep-frozen foods which represent 4% of the total. Finally, we find coffee with 3.8% and pet food which represents 0.7% of the sector. The “other food types” heading represents 10.3%, and includes sauces, yoghurts, products in oil and vinegar, olives, baby food, sweets and chocolates, etc.

- The “non-food” area is represented almost exclusively by the cosmetics/ pharmaceutical and household cleaning sectors which account for 5.5% of the market. For both cosmetics and for householding cleaning, converted flexible packaging is widely used for refills, in which coupled flexible containers with closure are increasingly common: they are easy to stack in the stand-up format.

| 2023/2008 | |

|---|---|

| Plastic | -1.70% |

| Paper and cardboard | -4.00% |

| Raffia | -3.40% |

| Flexible | 17.10% |

In conclusion

In the light of the above considerations, we can say that converted flexible packaging has numerous advantages, started from its lightness and easy handling: its dimensions and reduced weight facilitate transport, with positive impacts also on the reduction of environmental impact. The possibility of using biodegradable or recycled materials makes it sustainable, and therefore in line with increasingly widespread environmental awareness.

It is, finally, customisable, making it a winner from two points of view: firstly, it can be adapted to the product that it has to contain; secondly, it’s possible to reproduce striking prints and graphics on this type of packaging, to the advantage of marketing and communication.

Comparison of evolution of flexible packaging production with total packaging