The global packaging industry: elements towards looking to the future

Analysis of development trends on the global market as of 2022/2024: from key countries to competitive scenarios, products and materials according to Mecs - Centro Studi Ucima (data updated to October 2020). Plastics will grow, small sizes will be preferred (within 100 ml/gr) and Asia will be the area that will perform best. After the decline expected in 2020, packaging machines will rise again in 2021, to reach the same levels as 2019 in 2022.

MECS (MANUFACTURING ECONOMIC STUDIES) is the new brand of the study center created by Ucima and Acimac that offers, in an organic and comprehensive way, market analysis, economic forecasts and statistical surveys on the sectors of instrumental mechanics and related upstream and downstream industrial supply chains. MECS Srl proposes itself as a partner of Italian companies, in order to support their knowhow, and therefore their competitiveness, on an international scale by providing tailor-made information and reporting. http://www.mecs.org

MECS (MANUFACTURING ECONOMIC STUDIES) is the new brand of the study center created by Ucima and Acimac that offers, in an organic and comprehensive way, market analysis, economic forecasts and statistical surveys on the sectors of instrumental mechanics and related upstream and downstream industrial supply chains. MECS Srl proposes itself as a partner of Italian companies, in order to support their knowhow, and therefore their competitiveness, on an international scale by providing tailor-made information and reporting. http://www.mecs.orgThere will be more than 300 billion more pieces on the shelves of organized distribution worldwide by 2024: this is the most significant data that emerges from the forecast analysis carried outby Mecs-Centro studi Ucima on the global trend of packaging machines and the main target sectors. In a world characterized by increasing complexity, uncertainty and rapid change, this is a key indicator that bodes well for the future of the demand for new technology. The report also provides projections on packaged products and materials, outlining the main trends that will shape the global scenario over the next four years.

Scenarios

Asia top player on the world stage

In 2020, it is estimated that the number of packaged products sold globally will reach 3,844 billion, of which almost half (44.5% or 1,709 billion) will be concentrated in Asia. Europe takes second place, with a quarter of the market share (25.3% to 973 billion units), followed by America with North and South America absorbing 14.5% (557 billion units) and 10.4% (401 billion units) of the market respectively. This is followed by the area of greatest prospective development, i.e. Africa and the Middle East, which runs at a rather slow pace (5.3% at 203 billion units).

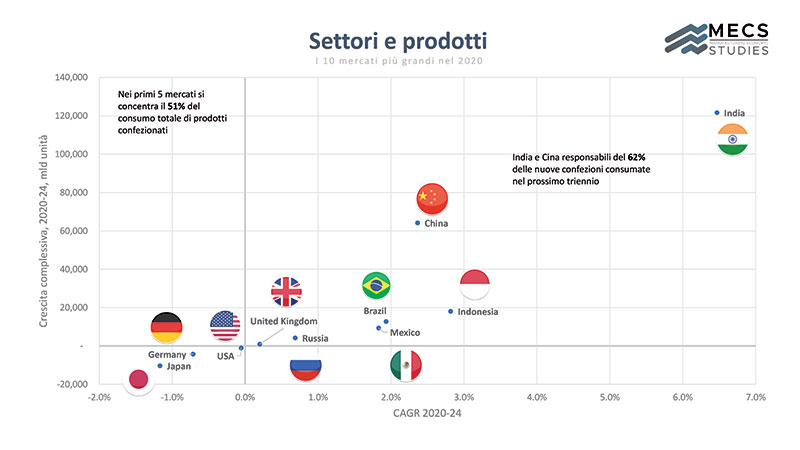

What will happen between now and 2024? The great potential of Asia clearly emerges, which remains a key player in the growth of the sector (+3.2% the average annual growth rate, the so-called CAGR), concentrating 75% of new packaging (3 out of 4). Although with overall volumes still very low, the other area that is developing rapidly is the Middle East/Africa (CAGR expected over 3.5%). Growth close to zero is affecting mature markets such as North America, Western Europe and Australia. In total, over the next four years, it is estimated that there will be about 300 billion new packs of which, to provide a proportion of the market, over 220 billion concentrated in Asia and 24 billion in Africa. Analyzing the individual nations in detail, it is clear that China, which has always been the engine of global growth, will beovertaken by India, which will grow in the order of 6.5% compared to the2.4% of the Asian giant: the two countries together will be responsible for 62% of new packaging consumed by 2024. The United States, Germany, Japan, the UK and Russia have low or even negative growth rates, while Brazil, Mexico and Indonesia promise positive performances of 2 to 3% per year.

Products and packaging materials

Which (among the products) will drive the development of new packaging?

Soft drinks, dairy and confectionery (in order of volumes produced) will be the most dynamic segments that will absorb a total of 73% of the 200 billion new packs expected in the next three years (2021-2024).

Other estimated growth areas are salty snacks, food oil, cookies, sauces and baked goods, pasta/noodles and spirits.

With an estimated loss of about 6 billion units, processed fruits and vegetables, ready meals, processed meat and fish, and finally soups, are contracting. A possible key to interpreting the negative trend could be the lockdown effect that has induced people to cook meals at home, favoring the use of ingredients over ready-to-eat foods.

In detail, in the food sector the most promising foods are sugar confectionery (60 billion pieces in the next 4 years; + 5.4% Cagr) and yogurt (30 billion pieces; +3.9%), but salty snacks, rice, alternatives to milk, oil, cookies and fresh milk are also growing.

In the beverage world, natural bottled water (more than 57 billion new packs) will prevail. With smaller quantities but with a decidedly higher CAGR one has theRTDs (alcoholic drinks based on fruit or juices), set to achieve a performance of +8%. Aromatized water (+4.7%), energy drinks (+3.7%); sports drinks and carbonated water on a par (+3.5%) are also set to do well.

Product-material matching: whatis goingup and what is coming down

The analyses conducted by the Mecs Study Center also examined the future trends of the materials used on three specific product categories: chocolate, sauces/condiments and juices.

Despite the fact that it has been under indictment for some time, plastic is the one to win the challenge, being expected to increase in the first two compartments and substantially remain stable in the third, where the favorites are cardboard and glass.

The use of aluminum recedes in the sauces and juices segment, the composite materials will be less used to pack juices and chocolate, but will advance in the packaging of sauces/condiments (estimated area of growth of over 7 billion pieces).

Among the materials, plastic wins

Regardless of the type of product, almost 60% of ackaging already uses plastic materials today. Within the industry, 52.7% is absorbed by flexible plastic, 24.5% by PET and 11.1% by thin plastic containers: these three areas account for about 90% of new packaged products. Paper packaging accounts for 14.9%, metals for 11.2% and glass for 7.9%. Composite materials close the ranking with 6.1%.

Plastics will also grow the most (over 228 billion new units by 2024). Flexible plastic packaging will drive the market with about 115 billion new packaged products, but will put in a lower rate of growth (2.3% per year) than PET bottles (+3.2% and about 80 billion units) and plastic pouches which, although with a share of just 2%, will grow strongly at a rate of 5.5% per year. Tailing among the materials analyzed is glass, with an estimated CAGR of +0.4%.

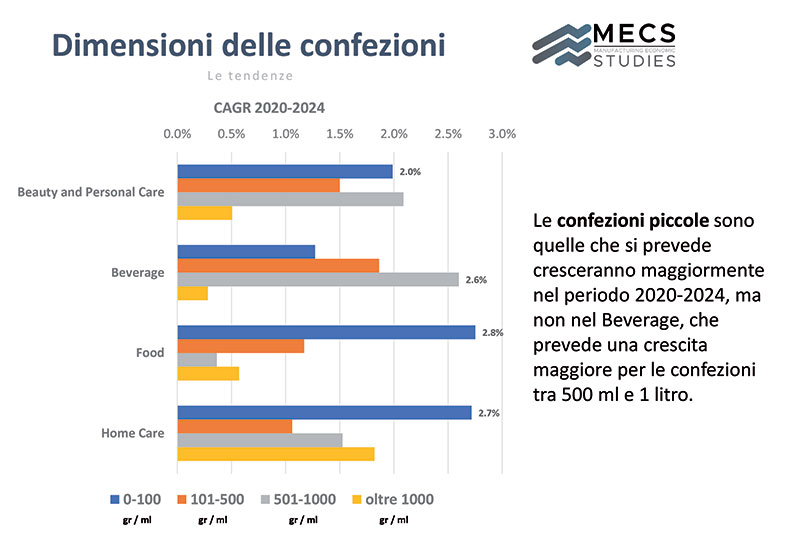

Small formats grow

The proliferation of small formats in almost all sectors will continue over the next 4 years due to the lifestyle of the modern consumer, who prefers practicality. Small packs (0-100 gr/ml) are the ones that will grow the most in the beauty and personal care sector (+2% per year), food (+2.6%) and home care (+2.7%). Beverages show a different picture with a greater development for the packages between 500 ml and 1 liter being forecast.

The machine sector: visions and forecasts

Packaging machines will pick up again in 2021

In 2019 the packaging machinery sector reached a global value of 45.6 billion euros, concentrated mainly on three macro-areas. Asia with 36.5%, worth 1/3 of the market (including local production + imports), Europe has a share of 33.1%, North America 19.7%. South America and Africa/Oceania remain marginal areas and are worth just over 5% respectively.

Once the hurdle of 2020 has been overcome, which will bring with it a contraction of 8.5%, in 2021 figures will rise again - this is the trajectory predicted by the Mecs Study Center - to realign in 2022 with the levels of 2019 (+0.1%).

In fact, the decrease calculated for the current year will correspond to a loss of turnover of 4 billion euros in total (and 8 billion euros until 2022), data also confirmed by the global export figures for the first half of 2020 in which Italy and Germany are the worst in the “class” (-11.1% and -7.2%). On the other hand, the USA and Japan performed well, closing at +2.9% and +4.7%, while China registered substantial stability (-0.2%).

At macro-area level, the projection for 2022 shows Europe at -0.3% on average per year, with France recovering at +2% and Spain, UK and Germany still suffering (-2; -2.1 and -2.6%).

More marked, in the three-year period, is the decline in North America (-1.6% per year). The Asian area should recover well (+1%), thanks to Indonesia (+3.1%) and China (+2.2%) despite the decline in India (-3.4%) and Saudi Arabia (-1.6%).

The growth in South America will be a slight +0.2%, with Mexico (-5.1%) as the worst performer, Argentina and Brazil, on the other hand, will put in an encouraging (+2.6% and +1.4%).

Progress also for Africa/Oceania with +2.5%, which, however, have a very low weight in terms of market share.

In terms of sector performance, the best performers will be pharmaceutical machines with expected growth rates close to 1% per year.

By 2022, food and beverage technologies will recover the volumes of 2019, standing just above zero (+0.2% and +0.1% CAGR, respectively), while chemicals and cosmetics will still suffer slightly (-0.1%).