The packaging machinery market surpassed the 9 billion mark

Italian packaging and wrapping machinery manufacturers have closed another year of growth (+8% against 2022). The export market was particularly dynamic in 2023, reaching 7.2 billion euros (+10.5% against the previous year). The domestic market remains positive, albeit at a slower pace.

The Italian packaging and wrapping machinery industry has grown for the third year in a row, achieving record profits. In 2023, the sector more than doubled its already good results of 2022, generating a turnover above 9.2 billion euros (+8%) and taking its market share in the Federmacchine universe (National Federation of Association of Manufacturers of capital goods intended for industrial and handicrafts manufacturing processes) to 16%.

The result confirms the leadership of Italian technology on a global scale, successfully managing geopolitical and commercial uncertainty thanks to the strong productivity and efficiency of its plants, the wide coverage of the subcontracting network and the continuous interfacing between internal company research and customer production needs. 78.7% of total turnover was achieved in international markets and 21.3% in the domestic market. This data was reported by Mecs - Ucima Research Centre in its 12th National Statistical Survey, which provides a snapshot of the performance of the sector composed of 594 companies and 38,219 workers.

Significant growth in exports

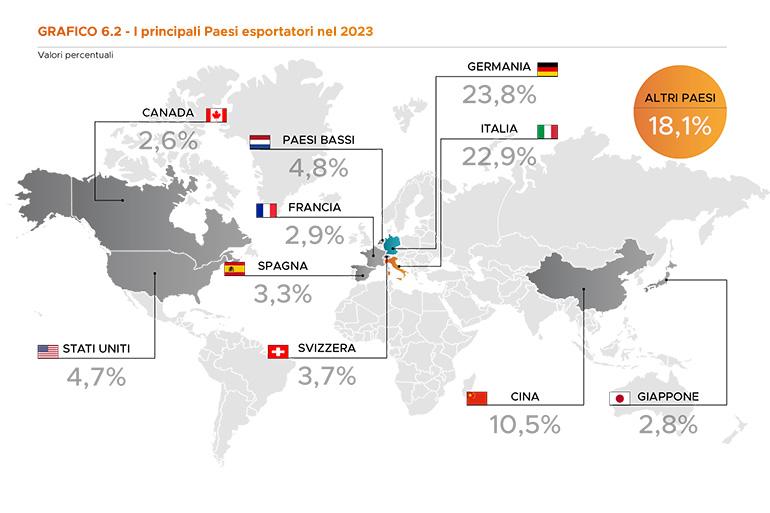

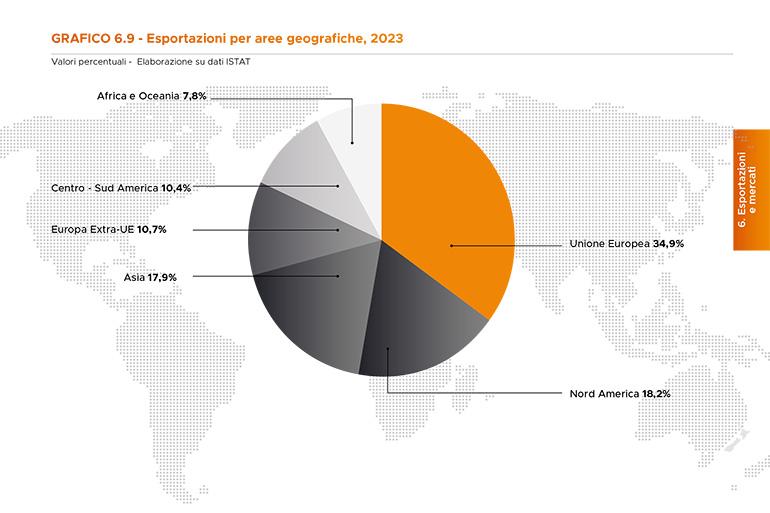

Italian manufacturers’ propensity for packaging technologies and solutions industry was once again confirmed in 2023, with foreign turnover increasing to €7.2 billion against 6.57 billion in 2022 (+10.5%). The sector exports all over the world, particularly to North and Central America and to many European countries which, as a whole, will have the highest absorption rates of Italian machinery in the coming years.

The podium of geographical areas remains the same. With €2.71 billion of sales, the European Union confirms its position as the main target area for machines made in Italy, accounting for 37.3% of all exports. Asia comes second with a turnover of €1.47 billion, representing 20.3% of the industry’s total international sales. Third place, meanwhile, was held by North America, with €1.25 billion, followed by non-EU Europe (€651 million), South America (€583 million), Africa and Oceania recording €456 and €135.8 million respectively.

Sales on the Italian market remained essentially stable (+0.2%) at €1.9 billion, making up 22.6% of total turnover.

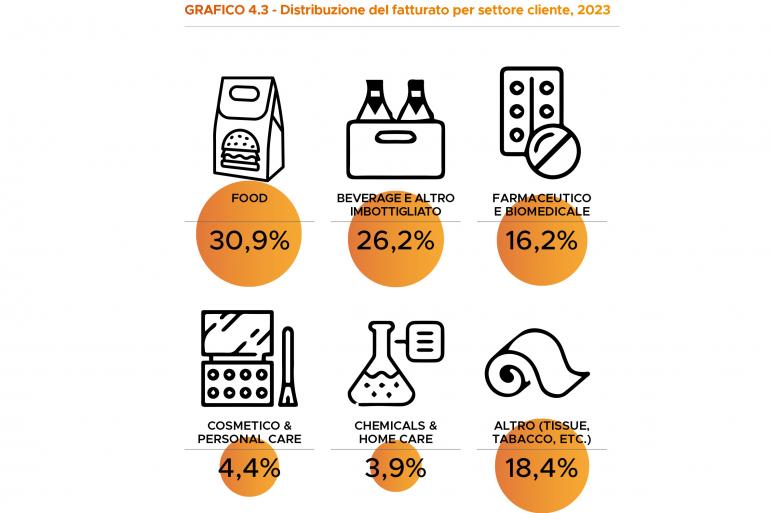

Food remained firmly at the top of the ranking

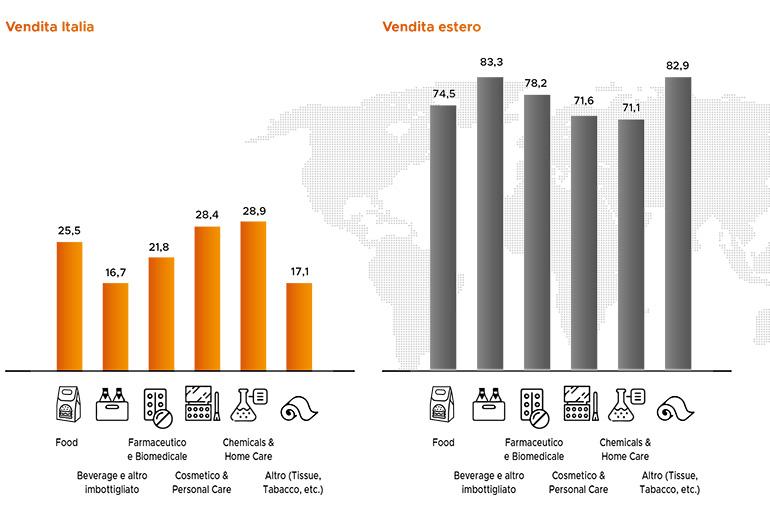

Among the sectors supplied, sales to the food sector remain in first place, accounting for 30.9% (2,856 million against 2,720 million in 2022) of total turnover, an increase of 5%, followed by beverages (26.2%) with 2,415 million, up 13.9% against the previous year. The “other” sector machines market (for tissue products, tobacco etc.) with 1,699 million euros (+6.8%) and the pharmaceutical sector with 1,492 million euros (+4.7%), follow. The cosmetics and chemical sectors also performed well, albeit with lower shares, with respectively 406.6 million and 359.7 million euros (+7.6% and +19.3%).

Turnover by product type

The primary packaging machine family remained predominant with 52.4% of turnover (+13.1%), followed by the end-of-line, labelling, and ancillary equipment segment (27.2% of turnover) and by secondary packaging (+3.4% compared to 2022), which takes up the remaining 20.4%.

The predominant category of machines is Forming - Filling - Sealing (FFS) machines and Thermoforming machines with a value of 2,033 million, up by 18.7%.

«Essentially, the aggregate data confirms how our industry and the entire Italian supply chain has established a method that guarantees reliability and innovation» states chair of Ucima, Riccardo Cavanna. «Our companies keep growing and setting themselves new challenges, implementing increasingly pioneering solutions that allow them to maintain their global leadership. As regards the domestic market, the introduction of the Italian law decree implementing Industry 5.0 provisions will give impetus to new investments that will drive growth. The goal for 2024 is to reconfirm the 2023 results».