When packaging is plastic

Trends in production and market positioning of rigid as well as non laminated flexible packaging and accessories.

Edited by Barbara Iascone

Based on the classification used by the Italian Packaging Institute in the publication Packaging in Figures, the plastic packaging sector includes both rigid packaging and non laminated flexible packaging such as shoppers, films, protective bubble wrap, etc. In addition to these two categories, packaging accessories are also considered, namely closures, ties, straps ...

Specifically, rigid packaging is mainly composed of so-called blown containers, ie beverage bottles, flacons for detergents, etc.; but thermoformed containers are also included in the category, such as trays used for packaging food products (ice cream, fruit and vegetables, meat, fish, etc.). With regards to non laminated flexible packaging, the trends of food-grade films and shrink-wrapping films for palletisation are described.

As far as the international market is concerned, according to the evaluations of Plastic Europe and based on the data for 2017 (latest available), the demand for plastics in the Europe of 28 has almost reached 51,200 t/000, 39.7% of which used for packaging production.

Market considerations

In 2018, the plastic packaging market, excluding converter flexibles, registered a growth rate in production in tons of +1%, exceeding 3,000 t/000. The trend in volume features a decline in the use of virgin plastics, balanced however by the increase in the use of recycled plastics, which alone are up 6%.

Rigid packaging “holds” more than flexible packaging, registering a +1.6% on its own.

As far as foreign trade is concerned, a drop in both imports (-2.6%) and exports (-1.1%) is registered. The downturn in exports is mainly due to stretch film for wrapping and accessories.

The segmentation of trade at geographical level sees Europe as the main area of exchange. 89.6% of Italian exports are directed towards Europe, with a clear predominance of Germany and France which are the main importers of plastic packaging; the flow towards Poland is constantly growing. The situation is similar for imports: the European scenario is the main field of action, and imports of plastic packaging from European countries account for 82.2% of the total. Also in this case Germany and France are the main protagonists.In terms of turnover, it is estimated that growth in the plastic packaging sector is 1.2%.

Analysing the price averages of the plastic polymers given by the Milan Chamber of Commerce, trends differ: the price of Nylon grows on average by 17%, the same as PET.

Spotlight on the rise of the price of PMMA (+19%) and the +5% of PVC. Polystyrene is stable. Polyethylene prices are down, on average by -4%. With regard to plastic raw materials derived from recycling, rPET continues to register double-digit growth rates: +20% for blue rPET and +10% for multicolor rPET.

Thus the progressive growth of recycled plastics and bioplastics in the production of plastic packaging continues. The use of recycled plastics, as already highlighted, grew by 6% in 2018.

Regarding bioplastics, mainly destined to the production of shoppers and wrapping films, according to 2018 data collected by the European Bioplastic association, Italy produced around 88,500 tons of bioplastic (biodegradable compostable), with an increase of 21% compared to 2017.

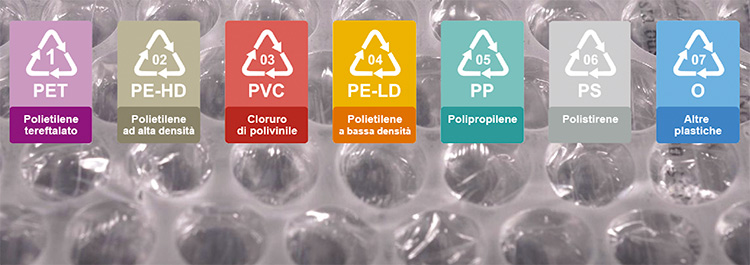

Plastic packaging types

Plastic packaging is divided into three macro areas:

- flexible packaging (films and bags, excluding converter flexibles);

- rigid packaging (bottles, drums, crates, pallets);

- accessories (straps, caps, chips, plates, stickers, etc.).

In 2018 a greater share of flexible packaging (mostly bags/shoppers) was registered.

Rigid packaging accounts for 44.5%, flexible packaging 46.8%, this excluding converter flexibles, the remaining part regards accessories (closures, protective packaging, ties, straps, etc.)

Application sectors

Plastic packaging is widely used both in the food sector (fresh and preserves food, drinks) and in the non-food sector (technical products, machinery, etc.).

Food is the area that has the highest presence of plastic packaging: 74.6%, of which 53% attributable to food proper and 21.6% to beverages.

In the food area, plastic packaging has found new vigor thanks to the expansion of consumption, also in Italy, of ready meals: sector in continuous expansion which, in 2018, grew by 10%.

The total packaging used to package “convenience foods” (trays and pouches) represents about 34% of the total plastic packaging used in the food industry (excluding beverages).

Another important area of use is that of chemical products (inks, colors, lubricants, etc.), where plastic packaging has a 7.4% share. Cosmetics and perfumery represent 3.8% of the user sectors of plastic packaging.

14.3% is attributable to components for plant engineering (handling, mechanical, electromechanical, textiles, etc.).

The variations in the dimensions of the different types of packaging from one year to the next are mainly due to the performance of the various sectors of use. In 2017, for example, the good performance of the chemical sector has also had positive effects on the various types of packaging used.

Finally, if plastic packaging, in its entirety, accounts for about 18% of the total packaging production in Italy, it must however be considered that we are considering values expressed in tons: this packaging is in fact part of the “light” category, with therefore very low weights compared to other materials. A broad estimate, which takes into account the real share of this type of packaging, could highlight a share of 25% in the total packaging sector.

Reasoning in terms of turnover, the representativeness of plastic packaging seen in terms of the total packaging sector rises to 46%, which becomes 53% if we also consider flexible converter packaging.

Recovery and recycling of plastic packaging

In 2018, based on the analyses provided by COREPLA (the supply chain consortium that deals with managing the recovery and recycling of plastic packaging within the CONAI system) plastic packaging coming from segregated collection managed by the consortium reached around 1,219 t / 000. Specifically, of this quantity, around 57% was sent for recycling with an increase compared to 2017 of 9.6%.

The part of plastic packaging left over from the sorting process that is not mechanically recyclable is sent for energy recovery.

Barbara Iascone

Istituto Italiano Imballaggio