Wood packaging - Data 2012

FACTS AND FIGURES Pallets, industrial packaging and crates are still essential to the manufacturing sector, despite the sharp decline experienced in 2012. Pallets and crates for transporting bulky merchandise still hold sway.

For the packaging sector 2012 was a truly bad year faced as it was with an economic recession that began in the last quarter of 2011.

For the packaging sector 2012 was a truly bad year faced as it was with an economic recession that began in the last quarter of 2011.

The contraction in manufacturing production has inevitably led to a significant drop in packaging production, naturally also involving wooden packaging, seen to be the packaging segment most affected by the crisis. Indeed in 2012 the segment registered a drop of 7.8% in quantitative terms, compared with an overall drop in packaging registered at 5%. Estimates speak of 2,057 wood packaging manufacturers (with approximately 10,200 employed), 12% of which specialized in the production of boxes and crates for fruit and vegetables, approximately 49% involved in pallet making and 39% operating as industrial packing makers. The segment also includes suppliers of basic materials for the production of wood packaging and importers of empty packaging.

Pallet producers also include pallet repairers.

A full 67% of segment are located in northern Italy, 13.5% in central Italy and 19.5% in the southern part of the country (including Sardinia and Sicily).

Market figures and typologies

Wooden packaging in 2012 registered an overall turnover of €1,500 million (-9% compared to the previous year).

Overall production for the same year is seen to stand at 2,096 t/000, -13% compared to 2011. Foreign trade as a whole witnessed a drop of 34% in terms of exports and a 15% drop in imports.

Apparent consumption worldwide is estimated to be at around 2,235 t/000 (-12.6%).

If pallets are widely used in all industrial sectors, industrial packaging is more than 70% used in the mechanical and electromechanical engineering as well as in the spare parts industry, while the remaining 30% covers a wide range of products (saddles for transporting piping, cable spools, wine and liquor boxes, corks etc.). Wooden crates are used 85% for the transport of fruit and vegetables while the remaining 15% are used in the fishery-, plant nursery and other sectors.

Industrial packaging

Industrial packaging

The main segment within industrial packaging (comprising a full 80%) is that of the large crates used to transport machinery or any part thereof. Their alternative in certain cases is constituted by the container.

The remaining 20% in this segment is accounted for by slats, liquor boxes and cable spools. Overall production in 2012 reached 550 t/000, marking a decline of 4.5% overall, set against a substantially stable production in the previous two-year period. Foreign trade is modest and is limited to liquor boxes and corks. 70-75% of the offer is accounted for by specialized companies that work for more than one customer, the remaining 25-30% is accounted for by internal production or companies that work exclusively for a single customer. Seen within the wooden packaging segment - industrial packaging features a system of specialized management, its peculiar characteristic being constituted by the allocation of products to specially designed containers.

Pallets

Pallets

This is the most widespread cross-sector form of transport packaging.

Seen in terms of the material that constitutes the same and with reference to the Italian market, there are four types of pallets, made of wood (91%), plastic (8%), cardboard (0.9%) and metal (0.1%), the latter only used for internal handling in heavy industry production centers.

Compared to 2011 plastic pallets have gained slightly on wooden pallets, the latter having receded by one percentage point.

Wooden Pallets

This is the much-preferred form of transport packaging that holds sway in Italy and throughout the world for its cost-effectiveness and safety. Different types of wood are used (fir, pine, beech and poplar), which confer a high level of resistance to the pallet. For several years now disposable pallets have gradually been replaced by returnable ones; the formula of renting pallets is also on the increase, with a consequent increase in customised pallets.

In 2012 wooden pallet production saw a global contraction of 18%: the numbers of repaired, recirculated pallets have shown a sharp increase (about +5%), while new pallets put in a significant drop. Foreign trade has also dropped sharply - exports and imports of wooden pallets are seen to be down by 37% and 24% respectively. Apparent consumption is seen to be down 17%.

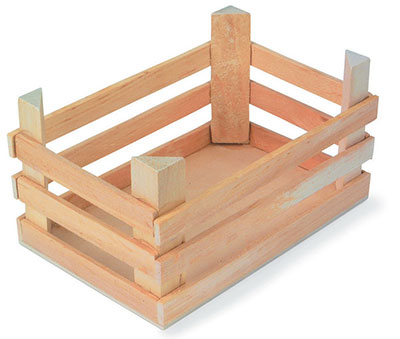

Crates for fresh produce

Crates for fresh produce

Regarding packaging, two types of wooden containers are used for handling fresh fruit and vegetables: bins and crates.

Bins are used for the transportation of fruit and vegetables from the field to storage centers, while crates are used for transportation from storage to distribution centers (largescale retailers, local markets etc..).

The wooden crates are all officially "disposable", but in actual fact an unofficial return system operates, that some fruit and vegetable sector operators estimate as comprising an approximate 2-4% of articles used.

In 2012 production stood at 275 t/000, -2% compared to 2010, while in terms of production for sale the share of the market is seen to stand at 22%, substantially in line with the previous year (but 2005 figures stood at around 30%!). Hence over the years the market share of this category has gradually shrunk, but it seems that the trend should now level off. Products for export and, in Italy, particularly those used for largescale retail show the greatest drop in share.

In recent years wooden crates have greatly improved their appearance and can now also play a "communicative" role.

Plinio Iascone

Istituto Italiano Imballaggio