The new assets of Italian large-scale retail trade in 2022

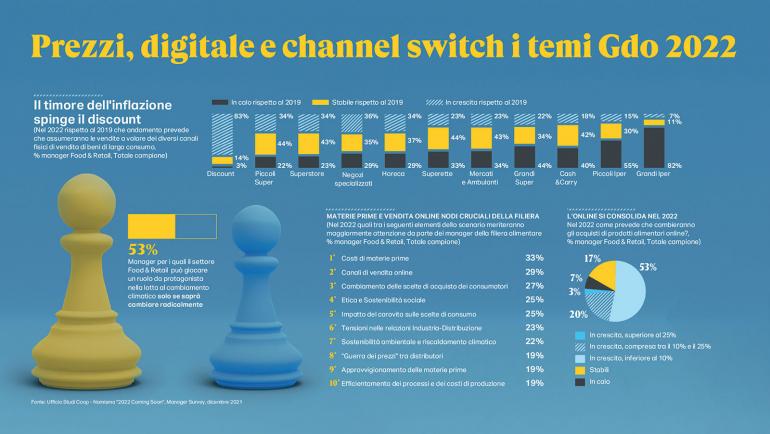

In the Coop survey “2022 Coming Soon - Manager”, conducted by the Coop and Nomisma Studies Office, the forecasted picture of the new Italian large-scale retail trade for the current year. Rising prices, digital and sustainability are the main elements on which to base a new offer model in a changing market, where discounters are gaining new market shares.

Milena Bernardi

Retail, especially food retail, is on the threshold of a great season of radical changes. For some years to come, it will have to come to terms with the strong transformation imposed by the pandemic and will be called upon to respond to the sudden changes in Italians’ buying habits, many of which have now become structural. For retailers, it will therefore be indispensable, if not urgent, to rethink their offer model and service options for end consumers.

According to the Coop survey “2022 Coming Soon - Manager”, conducted in December 2021 by the Coop and Nomisma Studies Office on a panel of managers in the food chain, almost one retailer out of two thinks this way «if we do not want to incur a progressive wear and tear on the performance and equity of the brand». Within the study, a cross-section of the phenomena that will characterize the evolution of large-scale retail trade in 2022 is shared, including price increases, challenges, risks, digital and the responsibility of companies on the ethical, social and environmental front.

A necessary switch

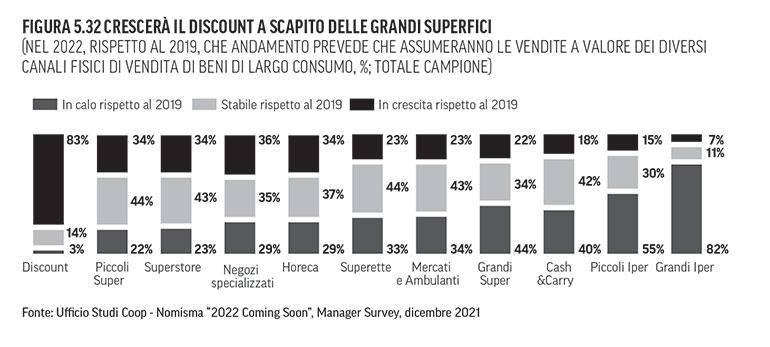

Compared to the pre-pandemic, there is almost unanimous forecast (already in the coming months) of a strong downsizing of the sales of large surfaces in favor of the marked growth of those of discount stores. Supermarkets and small supermarkets, which for some years now have been undergoing an overall restructuring process and offering a more proximity-based service, are also returning to relevance.

In the intentions of retailers, the reconfiguration of the supply chain must, in turn, include the reconfiguration of the sales network, perhaps pursuing full integration of the physical network with the new virtual channels. Online food sales, in fact, have almost tripled since the start of the pandemic and will continue to increase over the next few years, even though egrocery is still a very small segment of overall food sales (less than 3% of total retail sales).

Against this backdrop, it is interesting to note that the opinion of food industry managers differs somewhat from that of retailers. For the former, the priorities of large-scale distribution should focus on investments in egrocery and home delivery, with greater support for national and local production. More generally, about a quarter of respondents see the need to focus on specific target markets, abandoning the ambition to “serve everyone” that has long been an imperative of large-scale food retailers.

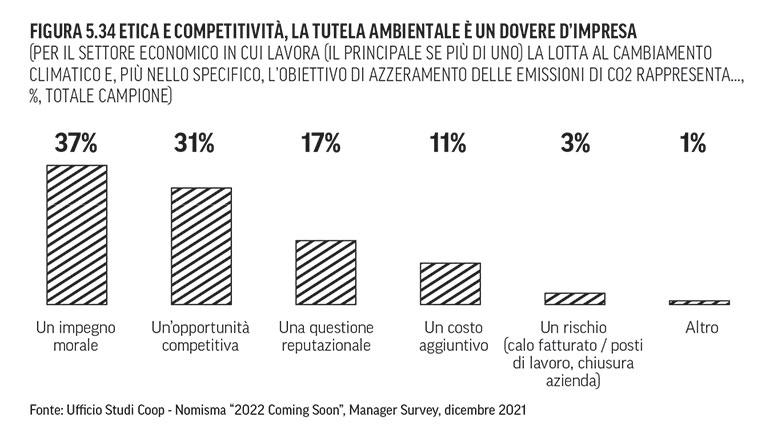

Alongside this intense reshaping, distribution companies are called upon to confront the major issue of sustainability by providing answers to the increasingly pressing demands of the end consumer. Among the managers interviewed, the fight against climate change is perceived not only as a moral commitment but also as a competitive opportunity for companies in the sector, which will, however, have to implement a radical change in the immediate future. It should be noted that the vast majority of retailers interviewed declare themselves committed to some form of environmental, social and economic sustainability.

With prices rising, 2022 will be the real test case

After years of substantial stability, consumer prices and those charged by suppliers to large-scale retailers will rise sharply (+3.5%), and more than half the sample expects growth of 4% or more. For the vast majority, this dynamic constitutes the main risk for 2022 (6 out of 10 managers interviewed fear that price growth will continue throughout the year).

Among the main causes of the increases, managers identify the cost of raw materials on international markets (51%), slowdowns in logistics and supply chain problems (45%), in addition to the serious impact of energy prices.

What is most worrying is undoubtedly the response of the end consumer, who will intensify purchases of products/brands on promotion (more than half of the managers interviewed think so) and will choose to buy from discount stores or cheaper outlets, causing competitive tensions in the distribution market. These phenomena are already evident if we consider that the discount channel already absorbs over 80% of the overall growth in large-scale retail sales and that promotional pressure on prices has grown by 1.1 percentage points, rising from 17.9% in 2020 to 18.2% in 2021 (the year ending in November), anticipating what will probably also be the dynamic in 2022.

The large-scale retail trade is therefore in a rather uncomfortable position, squeezed between increases in suppliers’ price lists and the real difficulty of recharging the prices of products destined for the end market.

The positive trend in sales continues

Despite estimates of a slowdown, FMCG sales consolidated their 2020 results in 2021, approaching 110 billion euros (-0.1%). The online channel continued its run but with lower rates (+23% in 2021 against +134% in 2020), while the development of discount stores is confirmed, increasingly closer to city centers, which convey 18% of sales and record a growth of 0.6% compared to 2020, with total sales of over 20 billion euros.

For 2022, the Coop Studies Office with the support of Nielsen’s analysis estimates a trend in total large-scale retail sales with a positive sign (+1.3% in value compared to 2021), the joint effect of a likely reduction in volumes, a larger increase in prices and the choices made by consumers to recompose purchases. In the current year, sales of discount stores will grow by 3.9%, increasing market share by one point. Revenues from drugstores (up 2.8%), supermarkets (up 1.7%) and the e-commerce channel are also expected to increase. The latter, which has now become part of the habitual way of spending, will however continue to grow at lower and lower rates (+14.1% in 2022 compared to 2019). Losing out in the channel dynamics will once again be the large surfaces such as hyper, which will suffer a slight drop in turnover (-0.2%).