Beauty: innovation values

According to the “Beauty 2023-2027 Report” by the consultancy firm McKinsey & Company, the global cosmetics industry is worth 427 billion dollars: this figure is expected to grow by 6% per year until reaching 580 billion in 2027.

this highly competitive scenario, Cosmoprof Worldwide Bologna continues to play a fundamental role in helping companies and operators to develop their business.

And it does this not just by offering top-class services, but also by understanding and analysing on the trends that will drive the market in the near future.

Below is a review of the underlying trends at the trade fair event that will act as a common thread in the evolution of the beauty world, ranging from technological solutions to consumer habits and from market orientation to marketing and communication.

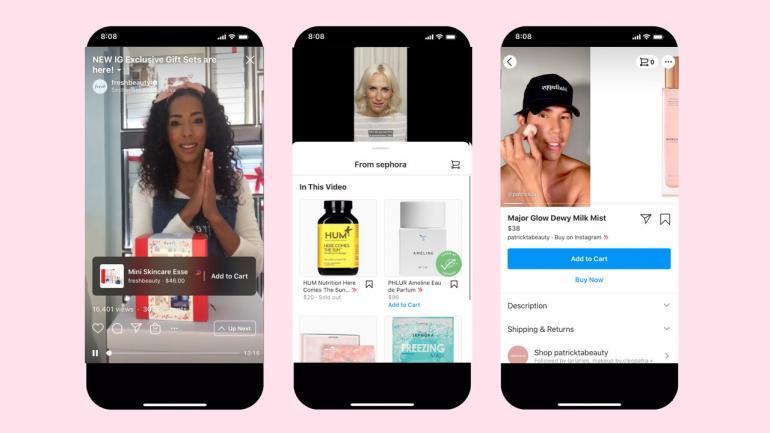

Technology and AI. The cosmetics industry is going through a period of great change driven by technology: from virtual Try-Ons to the use of Artificial Intelligence in production processes and in the traceability of cosmetic products, from new distribution channels – such as live and social shopping – to bio-tech innovations of new materials for the cosmetics industry and to the new metaverse dimension.

Sustainability 5.0. The cosmetics industry is a pioneer in the research and development of new ingredients, formulations and processes to minimise the environmental impact of production, launching on the market products in line with the principles of the circular economy. Major current themes in this sense include the procurement and processing of ingredients according to so-called “green chemistry”, biotechnology, indoor agriculture, ingredients coming from recycling processes… In addition, there is attention to a more conscientious use of water (not only with formulations that involve the use of lower quantities of water, but also which help consumers to reduce its use when consuming a particular product) and, finally, latest-generation packaging solutions: refillable packaging, single-material packaging and dispensers, take-back programmes and the recycling of containers and anti-friction technologies. We are in a new dimension of cosmetics packaging which, far from being a superfluous element, is today experiencing further development with a top-level industry working to achieve circularity.

Hyper-personalisation and the opening of new markets. Consumers are demanding products specific to their needs. Suitable treatments and proposals have to be found for every skin and hair type. This trend opens up new development scenarios for brands in defined markets still growing or to be explored, such as, for example, Africa and South-East Asia. In these geographical areas the spread of modern means of communication allows for greater awareness of local consumers. The “domestic” brands are still very strong, but the digital exposure of younger consumers can facilitate the entrance into emerging markets also of multinationals, able to offer collections adapted to the local population, climate and geographic characteristics, and to the local culture and tradition of particular areas.

Diversity and inclusion. There are no longer taboos linked to gender, age or the psycho-physical capabilities of consumers. Themes such as the recognition of different sexual identities and gender expressions or attention to the needs of consumers with disabilities, for greater accessibility to beauty products, are the order of the day for brands and cosmetic product developers. The market offers solutions adapted to each need, and the new technologies also permit the launch of new solutions in terms of formulation, user-friendly packaging and treatments.

Pro-ageing, or the end of anti-ageing. With the constant increase in the average age of populations throughout the world, the concept of ageing has changed significantly in recent years. Fighting ageing is now an out-of-date concept, and the cosmetics industry has for some years been offering products that don’t contrast natural ageing, but protect the skin and hair, improving appearance and safeguarding health. The need for acceptance on the part of the more mature generations has given rise to lines dedicated to what until recently were categories little considered by the market, such as women in menopause and consumers over 60.

Storytelling, value proposition and the new generations. The new generations will be the consumers of tomorrow: how to communicate with them, and how to gain their loyalty? This is the challenge for brands today, which have to adapt to new digital communication systems and tools; at the same time, they have to respond to media pressure regarding issues of social significance that are increasingly important for young people. A brand that does not clearly express its values, which does not openly take sides in relation to current social issues, which does not learn to use the same language and the same means of communication as the youngest generations will be unable to attract their attention.

Wellness and wellbeing. Proposals and brands with a holistic approach, with treatments that increase psycho-physical wellbeing and, as a consequence, self-esteem and self-acceptance, are increasingly growing in importance. As emerges from the already-cited McKinsey & Company 2023-2027 Report, the wellness sector is worth 1,500 billion dollars globally, with an annual growth forecast to 2027 that could reach 10%. Attention to wellness and wellbeing is bringing new operators into the dialogue between consumers and brands. First and foremost, trusted interlocutors, the "influencers" who we turn to for advice and products, are changing. Holistic operators, but also dermatologists, biologists and scientific professionals are now the most trusted ambassadors. Distribution channels and physical interaction spaces are also changing. Areas dedicated to wellness within major global retailers are growing, as well as business activities that involve spas, hotels and clinics in rituals and wellness treatments for body and mind.