Report on the state of packaging – Data 2017 (1)

Four-month survey of the packaging supply chain as of December 2017. Yearly performance estimates. Information on global economic outlook provided by Confindustria and Prometeia. Barbara Iascone

Below is a snapshot of the performance of the manufacturing industries with the highest consumption of packaging, subdivided into the macro-areas of food and non-food. Information on their evolution over time to follow.

Below is a snapshot of the performance of the manufacturing industries with the highest consumption of packaging, subdivided into the macro-areas of food and non-food. Information on their evolution over time to follow.

The performance profiles of the manufacturing sectors are based on figures developed by Istituto Italiano Imballaggio using information provided by Confindustria, Prometeia and sector associations.

FOOD

Food and beverage

According to analysis by Prometeia, the Italian food industry should end 2017 with some 1.7% growth in production. The sector’s performance has been propelled by a clear international preference for Made in Italy. On this point, worth noting is the recovery of Italian imports to Russia. Following the forced halt brought by international politics, many Italian producers will be eager to take up exporting to that country again.

|

GENERAL ECONOMIC OUTLOOK According to the Confindustria research center, Italy’s recovery is getting stronger, to the point that it has revised its September estimate of +1.3% for the year, bringing it up to +1.5%. Read the full article... |

Nor will the food industry be the only sector to benefit from the new situation, as the furniture and fashion industries join the bandwagon, albeit at a more modest rate. The same performance should repeat itself during 2018-19.

Looking at food and beverage separately, according to Istat, beverage saw a higher growth rate (January-October data), and should see 2017 close with some 5% growth, while food is growing at a rate of 1.5%.

NON-FOOD

Pharmaceuticals (excluding OTC)

With figures referring to the first half of 2017, Italian spending on prescription drugs saw 0.7% growth over the previous year. It should be stressed that the trend expressed by the Prometeia analysis refers to the entire pharmaceutical sector, including OTC drugs requiring no prescription.

Fashion system

According to Prometeia, Italy’s fashion industry began to recover already during 2017, with an approximate growth rate of +1.3%. This modest performance has been driven by the re-opening of imports by Russia, which is also driving the growth of other high end Made in Italy products.

Cosmetics and perfume

As for the cosmetic sector, 2017 seals the performance already previously recorded, with 1.2% growth in the domestic market. Total production will show a growth trend of 4.6%, while exports will rise 9.5%.

Furniture and decor

As with the fashion system, home decor will also benefit from the renewed support of the Russian market in 2017, with some 1.3% growth.

Chemical products

According to Federchimica, according to the latest available data, Italian chemical output shows a general growth trend of 2.5%, in line with the rest of Europe (+2.8%), driven by 1.5% growth in domestic demand. Imports rose by 2.7%, exports by 5%.

For 2018 further growth is expected, albeit at less consistent rates, with domestic demand at +1.1%. Exports will rise 3.5% and exports 2.5%. According to Istat data on the first 10 months of the year, domestic and industrial cleaning agents should see 4% growth.

Mechanical engineering (agricultural machinery, machine tools, machines for special applications, energy systems)

According to Prometeia, the performance of this sector in 2017 has ranked among the best in Italian manufacturing, with a trend that should see it close the year at approximately +2.8%.

Electric home appliances

No outstanding signals of growth for this sector either, as Italian operators continue to struggle to compete, albeit with some very modest growth (about +0.2% in 2017).

Construction materials

2017 confirms the recovery that began in 2016 in the construction business, which as is known, is tied up with that of materials (cement, concrete, bricks, rebars, etc.).

THE PACKAGING SECTOR

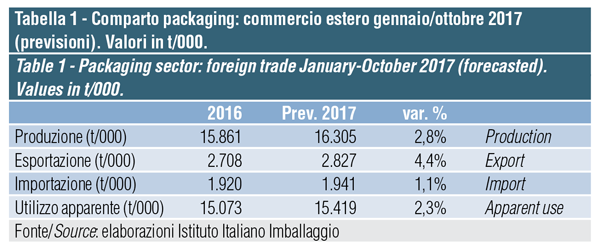

According to preliminary analysis by Istituto Italiano Imballaggio, with values expressed in t/000, 2017 should close with some 2.8% growth over 2016, bringing the amount of packaging produced in Italy to over 16,000 t/000.

Analysis of the first ten months of the year shows that foreign trade should close with +4.4% exports and +1.1% imports. Apparent consumption, which is calculated by summing production, imports and exports, closes the year with some 2.3% growth, thereby reaching 15,300 t/000.

Following the strong performance recorded during 2016, during which Italian packaging saw a production increase of 3%, 2017 also saw a positive trend with growth around 2.8%.

While, on one hand, exports found new vigor, on the other, domestic demand is having a salutary effect on Italian output. Steady growth of smaller packaging formats, especially in the food sector and dictated by the necessities of a changing society, contributes to performance of packaging.

However, the use of packaging needed to hold and move products is incentivized by the performance of a variety of sectors, which in 2017 showed strong growth trends. The development of alternate distribution channels has also positively influenced packaging, as well as the consolidation of online sales, which entails greater use of packaging for transport and protection.

RELATED ARTICLES:

General economic outlook