The Italian pharmaceutical industry excels in Europe

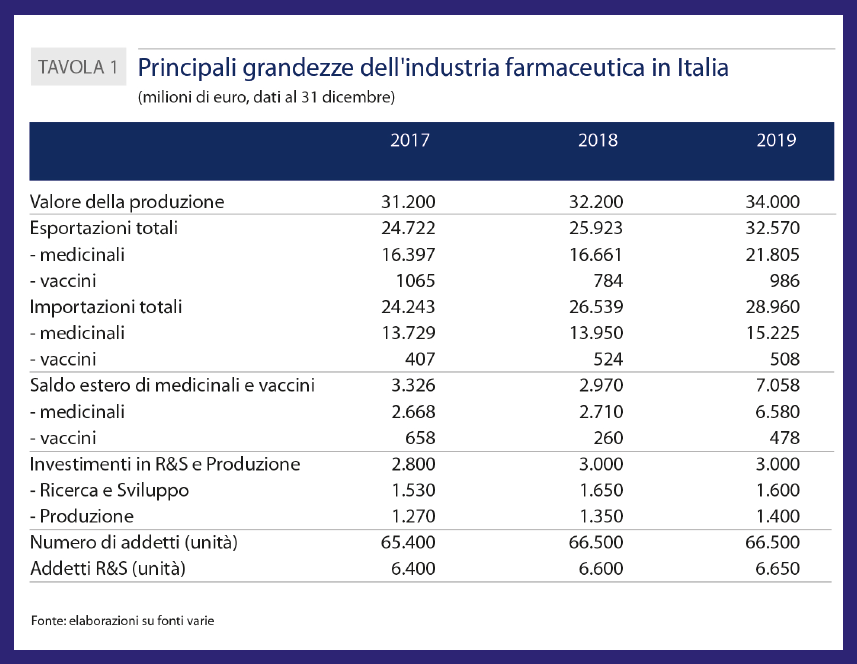

According to the Farmindustria-Prometeia 2020 report, in 2019 the value of production grew to 34 billion euros (32.2 billion in 2018), exclusively thanks to the growth of exports (+25.6% equal to 32.6 billion euros), which in the last three years accounted for 85% of the total. Milena Bernardi

It was already known that the pharmaceutical sector was strong and healthy, but the pandemic has certainly highlighted its weight and strong potential. In Italy, the industry continues to grow and invest by focusing on research and development, confirming its dynamism and innovative capacity.

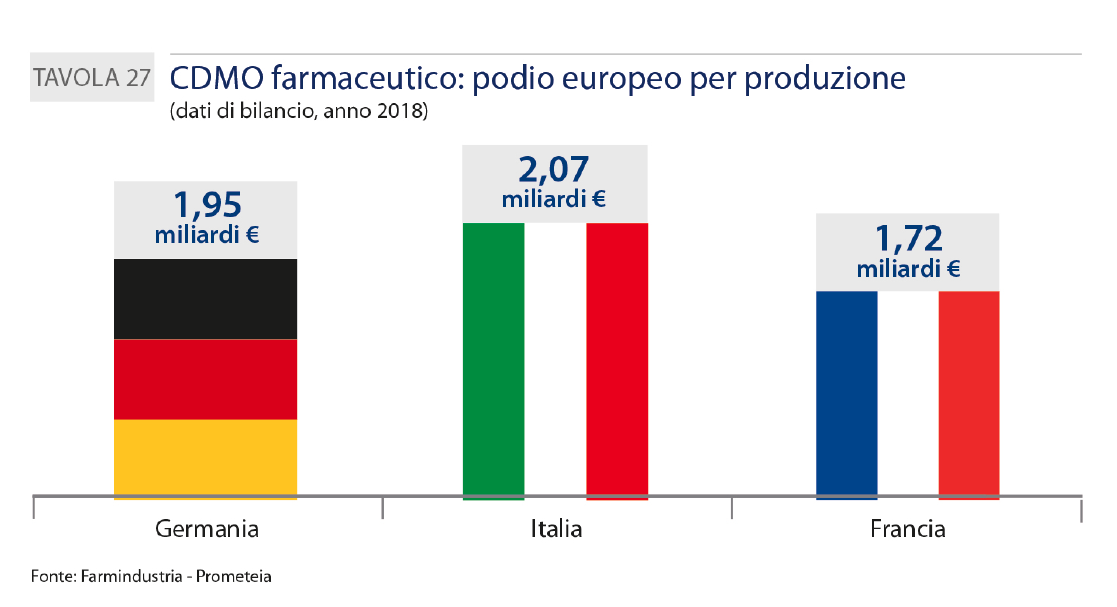

The data of the Farmindustria report elect it as the absolute protagonist in the European context, both in terms of production and in terms of investments in research and development (3 billion euros). The Italian region also takes the podium in Europe in the production of medicines for third parties (Cdmo) with 2.1 billion of production equal to 23% of the European total, obtained thanks to far-sighted 4.0 investments.

In terms of structure, the Italian pharmaceutical industry is composed in a balanced way of 42% by companies with Italian capital and 48% by companies with foreign capital: first among the large European countries for the presence of companies with US and German capital, second for French, Swiss and Japanese companies. Moreover, it is a world hub for the production of vaccines as far as companies with UK capital are concerned. Companies with Italian capital are characterized by a turnover achieved abroad of over 70% of the total, in considerable growth and significantly higher than the manufacturing average (40%). Figure 1

Covid emergency and the contribution of companies

2020 lockdown quarter, production was worth € 17 billion (€ 500 million more than in the same period in 2019).

Pharmaceutical companies have ensured continuity in the supply of therapies, responding in real time to shortages: Istat data estimate at 26 million people who normally take drugs, a number that, also considering households, involves almost the entire population in Italy.

In addition to the strong contribution to the economy, the trend has allowed employment levels to remain stable, thanks also to the adoption of important risk prevention measures, with task forces on work organization, production, clinical research, distribution, scientific information, to share best practices and identify solutions that have guaranteed operational continuity in complete safety.

The increase in exports confirms the competitiveness of the sector

In 2019, exports of the Italian pharmaceutical industry confirmed the growth trend that has already been underway for several years (+56% in the last five years compared to +19% for the manufacturing average).

Overseas sales of the sector (medicines, basic substances, other products) increased by 25.6% reaching € 32.6 billion, of which € 21.8 billion concern medicines. Total imports amounted to 29 billion euros, up 9.1% with medicines at 15.2 billion euros.

The balance for medicinal products is positive, amounting to 6,580 million euros, as is that for vaccines, amounting to 478 million euros.

The propensity to export, i.e. the exported share of production is 96% for the total pharmaceutical sector, a strong increase compared to 39% in 1999 and 52% in 2009.

The breakdown by product sector shows that medicines predominate, accounting for 67% of exports and 53% of imports. Basic substances and other products account for 30% of exports and 48% of imports. Finally, vaccines account for 3% of exports and 2% of imports.

In terms of geographical destinations, European countries predominate (68% of exports and 81% of imports), with the 28-country European Union representing by far the largest component (56% of total exports and 70.6% of imports). Among non-European countries, the main trading partner is the United States (17.9% of exports and 14.3% of imports).

Trade with Asia is also significant and growing, accounting for 9% of total exports and 4% of imports. This is followed by Belgium with 14.7% of total exports, Germany (10.9%), Switzerland (9.2%) and France (7.4%). Figure 2

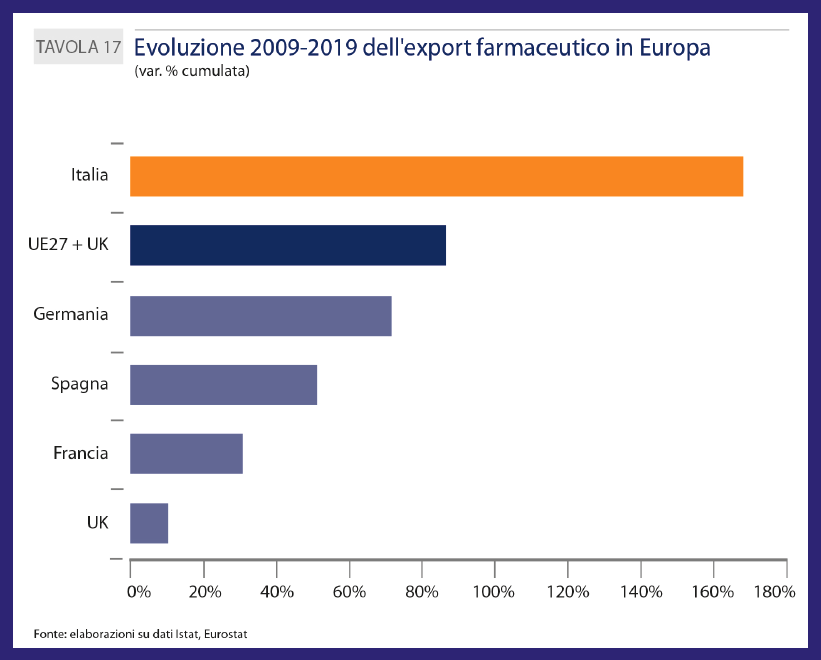

According to the data published by Aifa, in the last ten years Italy has recorded the highest increase among the big European countries: +168% compared to +86% of the EU average.

Investments in research and innovation are up

In 2019, Italian pharmaceutical companies invested in research and development an amount equal to 1.6 billion euros, corresponding to 7% of total investments in Italy. From 2013 to 2019, the growth was 31% (+24% the European figure), corresponding to 400 million more. Several areas of specialization have benefited, from biotech drugs (over 300 products in development) to vaccines, from blood products to advanced therapies (2 out of 10 authorized in Europe are born in Italy), to orphan drugs.

In the clinical phase every year Italy invests over 700 million euros or 21% of the total in the EU (it was 18% in 2014). More generally, R&D expenditures are 17% of added value (10 times the national average) and employees 10% of total employment: parameters for which pharmaceuticals are well above the national average (R&D expenditures/GDP1.4%; R&D employees/total employment 1.1%). Figure 3

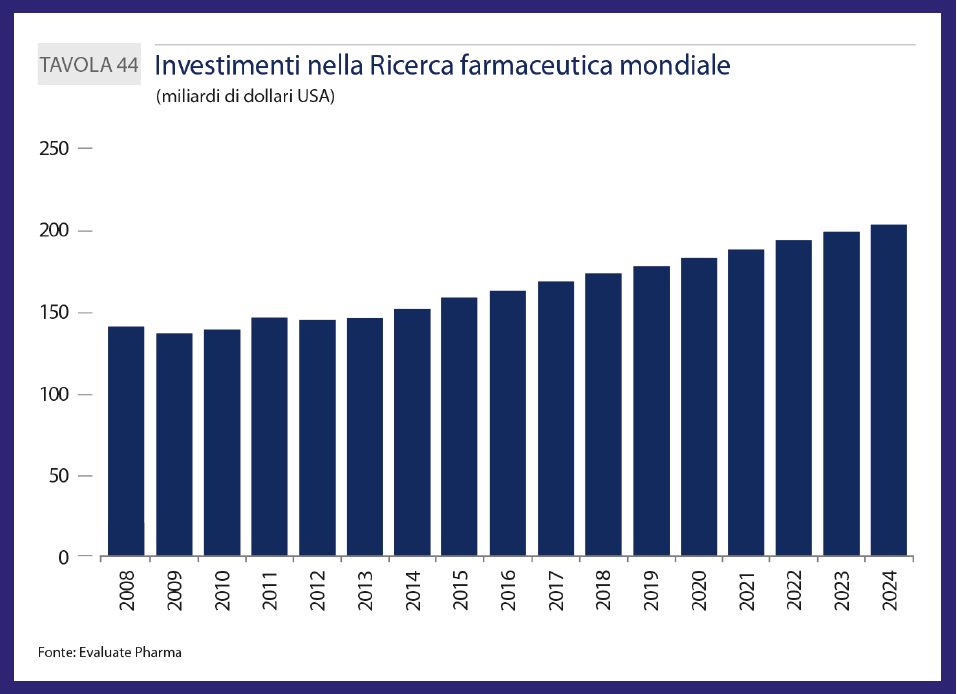

Globally, the pharmaceutical industry is expected to invest around $1 trillion in R&D over the next 5 years, the largest investment worldwide among all sectors.

Growing employment with quality resources

Even from the point of view of human resources, the pharmaceutical industry in Italy is proving to be an advanced sector: the quality and level of competence of employees is the primary factor of competitiveness and a fundamental driver for the economic and social development of the country.

90% of pharmaceutical workers have a university degree or diploma, a significantly higher percentage than the 63% of the industry average. Compared to other sectors, the sector stands out for higher productivity, more investments per employee (+310% compared to the manufacturing average), both in production and R&D and in environmental protection.

In terms of employment growth, Istat data reveal that between 2014 and 2019, the sector has increased direct employment more than all other sectors (+10% compared to +5% for the average), reaching 66,500.

The value of the environment

Pharmaceutical companies in Italy have taken the environmental challenge very seriously, consistently pursuing the objectives set. In ten years, considering the growth in production, they have in fact reduced emissions of greenhouse gases by 50%, compared to -27% for the average manufacturer, and have reduced energy consumption by 48% compared to the average of 15% for the manufacturing industry.

The results are the result of companies’ green technology investments of 44%, compared to a manufacturing average of 37%.

In 2015, the pharmaceutical industry also initiated what is known as Eco-Pharmaco Stewardship (EPS), a European industry-led program to intelligently and sustainably manage the environmental impact of the drug throughout its life cycle.