Report on the status of packaging

The four-monthly monitoring report on the packaging supply chain. Data referring to December 2024. General economic scenario and analysis of manufacturing activity with the consequent evolution of the packaging sector

Barbara Iascone

In this article we summarise the performance of manufacturing industry sectors where the consumption of packaging is most intense. It should be noted that the data here reported are of a preliminary nature, in the absence of official final figures for 2024, which will be made known by category associations in the coming months.

Manufacturing data

As is now widely recognised, the packaging sector is closely linked to the manufacturing industry, particularly the food, beverage, consumer goods, pharmaceutical and cosmetic supply chains.

Below is a brief overview of the trends of the sectors most associated with the packaging world, listed in order of “performance”.

• The cosmetics sector confirms its good state of health, with Cosmetica Italia forecasting for 2024 a growth of around +10%, driven by the excellent trend in exports (+15%). The domestic market will also contribute positively, albeit to a lesser extent, with a growth estimated at around +6% compared to 2023.

• The pharmaceutical sector and the consumer goods sector show positive trends, with an estimated increase of +4% for both.

• The food&beverage sector should, instead, record a modest growth, of around +0.8%.

• Positive trends are also expected for the chemical intermediary and metallurgical sectors, with an increase, respectively, of +1.5% and +0.9% compared to the previous year.

• A slight increase for construction products and materials (+0.3%), affected by the performance of sectors linked to public works. In this context, however, there has been a significant fall in the glass and ceramics sector.

• Negative performances are recorded by the fashion (-5.5%), furnishing (-1.5%) and domestic appliances (-0,6%) sectors. With regards, specifically, to the latter sector, the situation was aggravated by reorganizations and the problems that have affected important operators in the sector.

The packaging sector

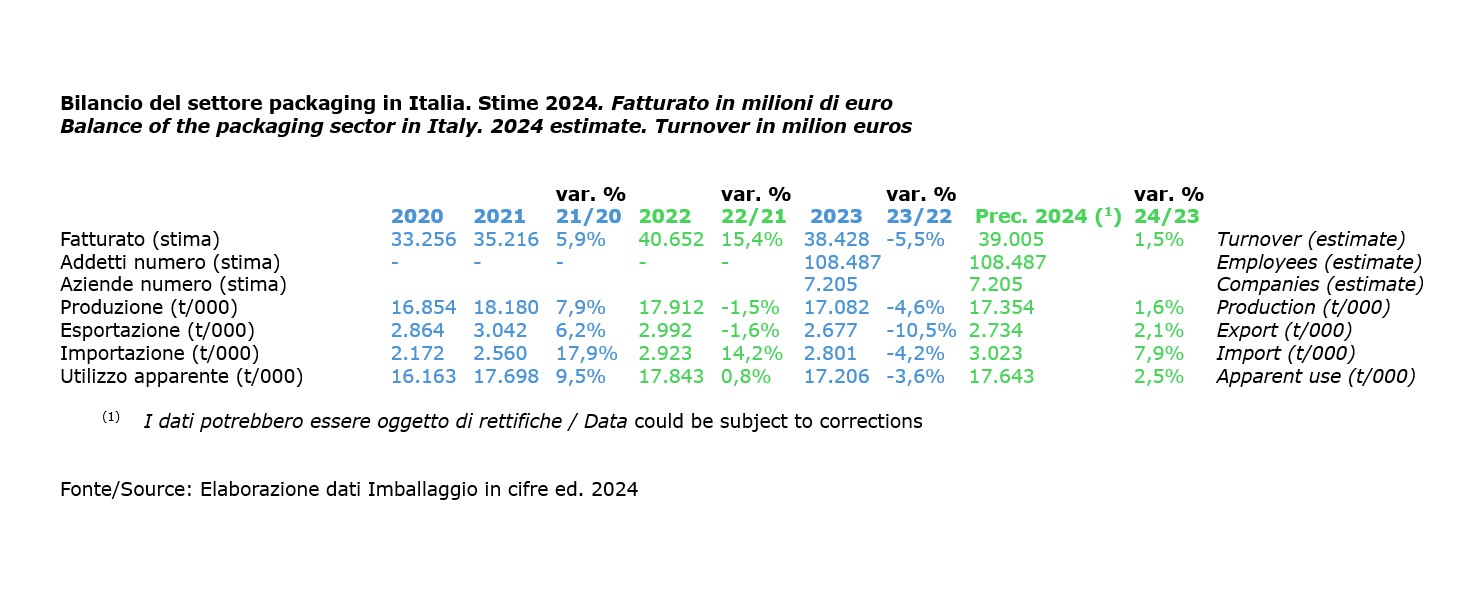

After a contracting 2023, the Italian packaging industry should record an initial recovery in 2024, with a production growth of around 1.6% against the previous year: total production should, in fact, exceed 17,600 t/000.

The packaging industry, therefore, finds itself facing a similar situation to that of the manufacturing industry in general: the good performance of the packaging sector derives from the trend in user sectors, at least those that have received an essential boost from the increase in exports and which, as a result, have expressed greater demand for packaging produced in our territory.

The positive exports trend in the manufacturing sector also had positive knock-on effects on industrial packaging used for transport and logistics, whether in corrugated cardboard, wood or plastic.

Materials data

Analysing the individual materials used for the production of packaging reveals that the recovery is driven by an increased use of paper (+3%) and plastic (+3.5%). With regards to cellulose-based packaging, it was corrugated cardboard, used mostly for transport/logistics, that provided the positive momentum.

Plastic packaging benefits from the good performance of the main sectors of use.

Aluminium packaging is also up (+4%), driven mainly by the demand of the cosmetic and pharmaceutical sector, showing a positive trend.

Another trend to highlight is that relating to converted flexible packaging, which should arrive at +3.5%: notwithstanding food being the main outlet sector, cosmetics and pharmaceuticals have partly supported the growth.

Steel packaging (+1%) also contributes to the overall performance of the packaging sector, supported by the positive performance of canned food.

Good news for wood, finally, which stands at +0.8%.

The only negative trend appears to relate to glass, due mainly to the increase in imports to the detriment of national production and not to a decrease in demand. Further analysis is needed for a more precise evaluation but, nevertheless, a fall of around -1% can be expected.

To conclude

The foreign trade deficit trend in packaging continued in 2024. Imports exceed exports, reaching a value of nearly 290,000 tonnes, a sharp increase compared to around 123,000 tonnes in 2023. Imports grew by 7.9% compared to the previous year, while exports recorded an increase of 2.1%.

The increase in imports relates to almost all materials – including steel and paper – but in terms of tonnes, the principal imported items are glass (+1%) and plastic (+14.9%).

Again in 2024, as was the case for 2023, there should be an alignment between production and turnover performances; the latter should record a growth of around +1.5%, exceeding 39 billion euros. The performance is a physiological reaction to the negative performance recorded in 2023.

With regards to the raw materials used for packaging production, there were no particular price pressures in 2024: prices remained largely stable for all the materials involved, thus limiting any increases in the cost of individual packaging.