Italians: poorer, but… still untroubled

“Rapporto Coop 2023 - Consumi e stili di vita degli italiani di oggi e di domani”* (Coop 2023 Report – Italian consumption and lifestyles of today and tomorrow) envisages several possible worlds, which are currently rather gloomy. The high cost of living is reducing consumption and forcing Italians to make new sacrifices which, in part, also includes food. Yet, what Italians are not willing to give up is a calm, stubborn optimism.

Ongoing economic and social emergencies, winds of war, geopolitical transformations, a falling birth-rate, an ageing population and, last but not least, climate change with its 2,300 extreme events occurring in 2022. We are living through uncertain times, characterised by a “global disorder” which is certainly concerning, and which will mark a sharp reversal in Italians' spending intentions (36% intend to reduce consumption against only 11% that are thinking about spending more).

Worsening the outlook is the sharp increase in inflation which only in the last two years has reduced purchasing power by 6,700 euros per capita, with the result that only one interviewee out of 4 declares to lead the same life as a few years ago.

With regards to employment, which there seems to be up to now, (in 2023 there are 23.5 million employed, the highest figure since 2008), it’s employment that “doesn’t pay” what it should (70% of those employed declare to need at least another month’s pay to live a decent life) and results in the increasingly evident tendency to have more than one job as a strategy against the high cost of living. And yet, Italians continue to be optimistic, even if they have no choice but to live with a family budget that is increasingly subject to daily sacrifices. They try to limit waste, avoid products not strictly necessary and resort more often to the second-hand market.

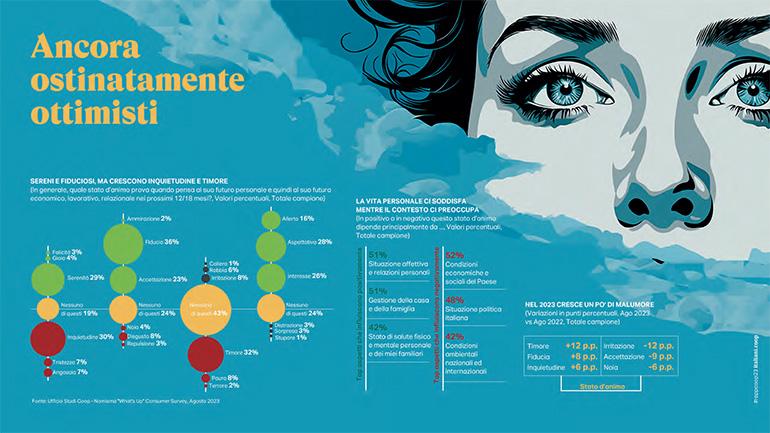

An inscrutable underlying serenity

The photograph taken by the Coop 2023 Report is of a country which is certainly concerned (30% declare to be so, +6% against 2022) and with growing fears (from 20% to 32%), but which sees feelings of confidence (36%), serenity (29%), acceptance (23%) and positive expectations (28%) strengthened overall. Sustainability-oriented and informed, on the back of surprising confidence and great serenity of mind, Italians use their savings sparingly, all committed to working harder without indulging in feelings of fear, anger or resentment. The aspects which most influence this climate of optimism are, in fact, close relationships and family life, both mentioned by 51% of Italians.

This positive sentiment is certainly one of the great points of strength of Italian life but, at the same time, raise questions regarding its future sustainability and the possibility that in reality, there are subdued reactions currently incubating.

Some dysfunctional behaviours actually highlight all the daily fatigue: it’s not surprising to know that 1 Italian out of 3 declares to have used (also sporadically) psychotropic drugs and 1 out of 5 makes more or less habitual use of them. 2 out of 3 practice stress management techniques and drugs for hypertension, gastritis and stress stand at the top of the classification of most sold medicines.

Consumption slowing down

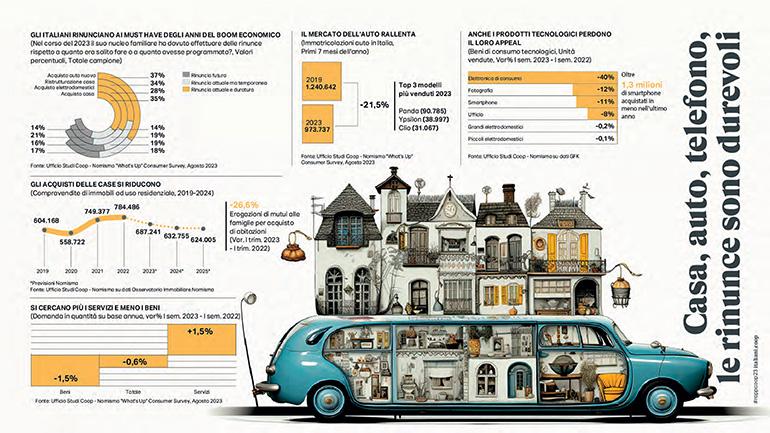

Aware of having become poorer, Italians have started to cut down on goods that are not strictly necessary. Property sales are falling (-14.5% 2023 against 2022 and -4% expected in 2024), and purchases of new cars and technological goods are diminishing. Specifically, sales of new smartphones have dropped by 10% in the last 12 months (over 1.3 m fewer telephones sold). The used or refurbished is replacing the new (33 million Italians sold or bought second-hand goods last year) and eating out during the summer has become less frequent. 51% of interviewees declare, moreover, the intention to reduce the number of social occasions outside the home in the next 12/18 months. (3)

Savings are made also on food

While Italians – in contrast with other European countries such as the United Kingdom, France, Germany and Spain – are generally willing to do anything but not make sacrifices on the quality of food, many of them (at least 14%) now seem about to surrender in the war against inflation that has increased the cost of food by more than 21% and which doesn’t seem likely to subside in the next two years. 72% of managers in the sector believe, in fact, that food inflation will not return to below 2% before 2025).

Italians’ supermarket trollies are, therefore, beginning to lose weight: -3% is the change in sales at constant prices in the first 7 months of the year and 60% of managers interviewed expect a further, albeit modest, drop in 2024 against 2023 (-0.5%).

After the reduction in quantities purchased, with the arrival of autumn, consumers appear ready to change strategy once more: shopping has become more frequent, loyalty to a particular purchasing channel has diminished. Own-brand products maintain their leadership with 83% of consumers declaring to buy own-brand products to cope with the increase in the prices of foods and beverages, while as many as 8 Italians out of 10 declare to be planning to begin to buy (or increase their purchases) at discount stores. According to 63% of Food & Beverage experts, discount stores will show the biggest growth among all retail channels in the next 12/18 months.

Food identity at risk

The number of people that have lost all attachment to identity has doubled in the last year (today 1 Italian out of 5, especially baby boomers and those of a lower social class), abandoning also the dictates of traditional food culture and the consumption of typical local products.

It’s a trend that could continue in the coming months and questions the concept of Italian food and the Mediterranean diet, starting from the consumption of fruit and vegetables: -15.2% in the last two years and, for 16% of Italians, will reduce further. This lack of identification seems to be more of a forced decision rather than a choice, and affects to a greater degree those who identify with the less wealthy social class, the southern regions and baby boomers.

Healthy, vegetable and sugar-free foods

Italians’ growing interest in a healthy and balanced style is playing an important role in these new consumption dynamics. New trends are making headway, especially in minority groups of the population. Plant-based products are recording sales up by 9% year-on-year and sugar-free products are outperforming all the “free-from” products, generating revenues of 623 million, a third more compared to 2021.

There is a significant consumption of protein products (sports foods, nuts, health drinks are growing). A tangible example is the increase in the number of Italian families buying products linked to this category: while in 2021 they numbered 6.7 million, in 2022 the number had grown to 8.1 million, an increase of 20.2%.

Attention towards physical wellbeing goes hand-in-hand with safeguarding the planet: 5.1 million Italians today declare to eat with zero waste, 2.8 define themselves as reducetarians (they have reduced their consumption of meat) and 1.4 are so-called climatarians (they use products with a low CO2 impact).

The new meatless era

The growing attention towards health, awareness of the environmental impact of food and concern for the wellbeing of animals are pushing Italians towards more sustainable food solutions. Interest for alternative proteins to meat is growing in particular.

Besides the well-established vegetable-based options (168 million euros in 2022; +12% compared to the previous year), Italians seem increasingly willing to explore less traditional alternatives and are opening up to the idea of including also synthetic meat (28% of preferences) and insect flour (29%) in their diet. According to a recent study carried out by the Boston Consulting Group, the spread of “alternative” protein-based products is destined to record a growth seven times higher than today's situation, moving from the current 13 million tonnes per year, to a volume of 97 million tonnes by 2035. It seems, therefore, that on the tables of the future, not so far away, what remains of traditional meat will only be the name.

* The report, of which we offer a summary, was presented on 7 September in Milan. It was drawn up by Ancc-Coop’s Research Centre with the scientific input of Nomisma, the analytical support of NielsenIQ and the original contributions of Circana, GS1-Osservatorio Immagino, CSO Servizi, GfK and Mediobanca’s Research Centre. Two different surveys ("What’s Up" and “Hybrid Future”) were again used for this edition, both carried out in the second half of August. The first involved a sample of 1,000 Italians over 18 (18-75 anni) representative of the population. The second was directed at a panel of the italiani.coop site community and involved 680 opinion leaders and market makers, users of past editions of the Report. Among these, 450 top roles were selected (CEOs and directors, businessmen, freelance professionals and consultants) capable of anticipating the country's future trends more than others.